Markets choppy as US government shutdown rumbles on

* White House see Federal Government layoffs in the 1000s

* Wall Street hits record highs as US government shutdown continues

* No non-farm payrolls and other government data to be published

* Bitcoin hits $120,000 for the first time since posting record highs

FX: USD edged higher as markets were relatively muted over the US government shutdown. There were no initial jobless claims number, and no NFP today so Challenger layoffs were a highlight – which is rare. The figure cooled to 54k from 86k. Also helpful in gauging labour market developments, was the Chicago Fed estimate on the unemployment rate, which stood firm at 4.3% from the initial September reading. On Fed speak, Goolsbee continued to sound concerned over inflation while Logan reiterated her hawkish tone. Both were wary about overly front-loading rate cuts. There’s 47bps of rate cuts priced in for 2025.

EUR softened very slightly with yield spreads retracing their recent pullback and moving higher. US rate expectations post-ADP have moved towards more policy easing. The technical euro picture is largely neutral with an RSI just below the 50 threshold. However, EUR appears to be trading with modest support above the descending trend line drawn from the July highs and the 50-day SMA at 1.1677.

GBP dipped as the UK bond market was once again in focus. The latest 10-year gilt auction generated the lowest oversubscription rate since December 2023. The UK’s fiscal outlook remains a core risk for the pound into the November 26 budget release. Rumour and stories around what tax rises may occur will likely be leaked into the media ahead of this date. Cable is relatively neutral on a technical basis currently too.

JPY was temporarily supported overnight by BoJ’s Uchida, who noted the Tankan survey showed positive business sentiment as the US tariff outlook recedes. The BoJ may raise rates if the economic outlook is realised.

AUD underperformed as trade data disappointed investors. CAD lagged its peers as oil dropped.

US stocks: The S&P 500 gained 0.06% to close at 6,715. The Nasdaq moved higher by 0.37% to settle at 24,893. The Dow Jones finished at 46,520, up 0.17% while small caps outperformed with the Russell 2000 up 0.66% at 2,458. There were record closes for all three major indices as they rose for five straight days. This is the longest win streak since late July with the S&P 500 up 34.8% since the post-Liberation day lows on April 8 at 4,982. Four sectors were in the green with Materials leading the gains and Energy was the biggest losing sector. Tesla grabbed the headlines after posting strong Q3 delivery numbers. Shares were initially bid, but questions over outdated forecasts and frontloaded buys amid EV credit expiration saw the stock eventually close in the red.

Asian stocks: Futures are mixed. Stocks traded firm after more record highs Stateside. The ASX 200 was supported by gold miners again with defensives lagging. The Nikkei 225 was boosted by pharma and metals stocks though yen strength capped more upside. The Hang Seng played catch-up due to the National Day closure, with Shanghai Comp remaining closed until next Thursday.

Gold surged again to new highs at $3,897 before paring gains as the dollar moved off its intraday lows.

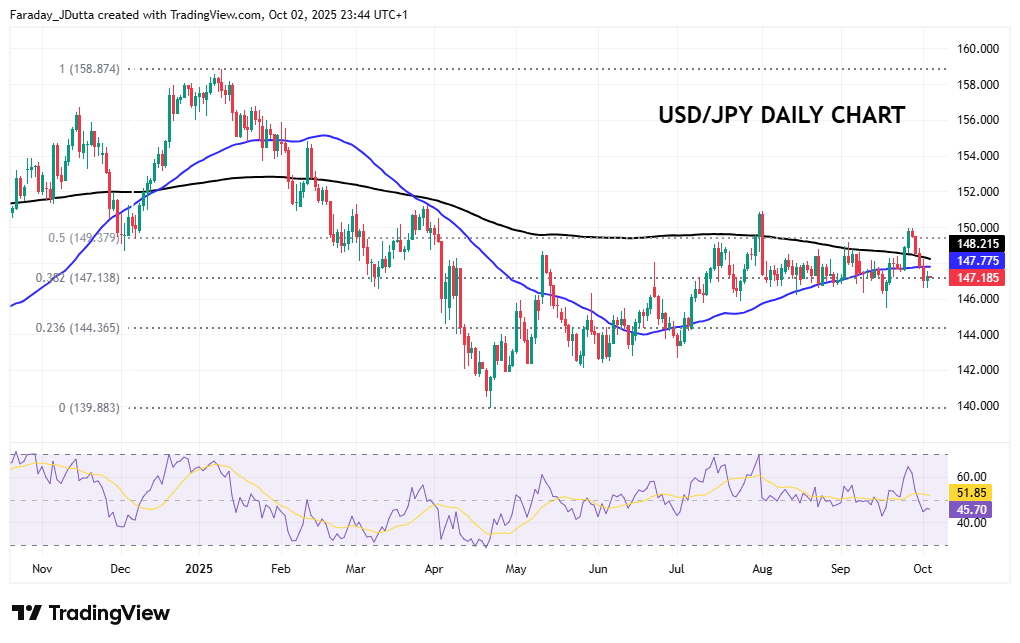

Chart of the Day – USD/JPY off resistance

The JPY has performed relatively well versus its peers over the last four weeks or so, outperforming most of the G10 currencies. Recent comments from BoJ officials have confirmed a shift in the central bank’s messaging towards a more hawkish stance as it prepares markets for a near-term rate hike. Yield spreads have narrowed to fresh multi-year lows in the aftermath of Wednesday’s US ADP, offering the yen critical fundamental support. The major found resistance again at the midpoint of the 2025 high to low at 149.37 and potentially also the 200-day SMA at 148.21. Support sits at the 38.2% fib level at 147.13.