Weekly Outlook | US shutdown to cause equities correcting?

Markets continue to be impacted by the shutdown of the US government. As several agencies stopped working important data release will be delayed. The outcome remains unsure. During the first tenure of President Trump this took five weeks. In case work is being resumed the Nonfarm payrolls report might follow this current week but could also face further delays. It is expected that 54.000 had been created during this period, which would be an increase compared to the 22.000 new positions during the month prior. On the other hand, the ADP data last week revealed that 32.000 jobs were shed from the economy, signaling a negative sentiment moving forward. The data, however, might support markets positively in the short run as the Fed is expected to continue cutting interest rates. Such moves usually support equities due to the increase in liquidity to markets.

Though, the focus also deviates from equities towards the crypto sector. Bitcoin had created a new all- time- high and also helps altcoins moving higher. As long as investors continue to pour into markets the crypto winter might still take time to unfold.

Important events this week:

NZ interest rate decision: Following the interest rate decision from Australia last week, this week the Royal Bank of New Zealand will determine their interest rate moving forward. It is expected that the Bank will cut rates by 25 basis points down towards the 2.75% mark. Despite the moving being expected, the NZD might continue to lose momentum against other currencies.

The weekly chart above shows that the market keeps heading lower. Capped by the 50- moving average at around 0.5900 the market might proceed to lower levels. The next support zone remains at 0.5555 as previously anticipated. Should the strength of the Dollar continue, the negative sentiment might also remain intact. The data will be released on Wednesday, the 08th of October at 03:00 CET.

US Consumer sentiment: The economy in the United States is based on consumption. Since the majority of the population lives between paychecks a decline in spending offers further insights into the state of the economy.

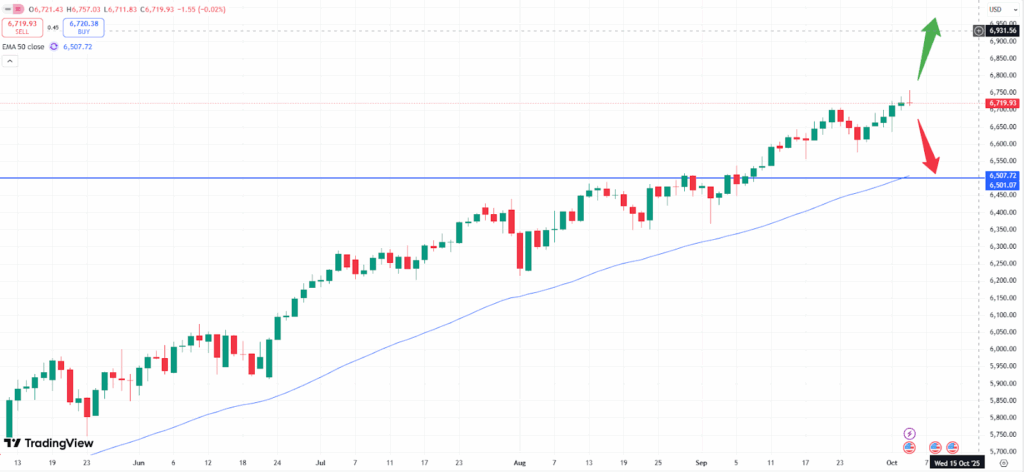

The S&P 500 index moved higher last week but printed a bearish- looking candlestick on Friday. This might indicate that the price will start to decline pushing the index potentially lower. Potential strength of the Greenback might also cause the demand to diminish. The month of September has been usually bearish in the past but exceeded expectations this year. The rate cut from the US helped prices moving higher. On the other hand, the shutdown in the US currently causes uncertainty, which might also be a reason why gold prices continue to move to the upside. The consumer sentiment report will be released on Friday, the 10th of October at 16:00 CET.