JPY plunges on election result, stocks up on tech gains

* Yen collapses, stocks surge after Takaichi elected Japan’s LDP leader

* S&P 500, Nasdaq hit record highs as AMD-OpenAI deal boosts tech enthusiasm

* US President Trump is pushing Israel and Hamas for Gaza deal within days

* Gold, Bitcoin soars to more all-time peaks on global debt pile concerns

FX: USD made highs in the middle of the European session before falling and closing in the green on the day. Remember that the euro has by far the biggest weighting in the Dollar Index (57%), with JPY (14%) and GBP next (12%). News flow shifted away from the US government shutdown with external political issues grabbing the headlines. The longer the closure goes on, the more pressure there should be on the dollar. Trump announced 25% tariffs on truck imports. The DXY continues to trade around the 50-day SMA at 98.03 with today’s peak retracing from the downward trendline from the May top.

EUR sold off over 0.7% initially on the French PM resignation news. But prices bounced back above the descending trend line drawn from the July highs and the 50-day SMA, now at 1.1680, through the session. The departure of French PM Lecornu has sparked renewed concerns about France’s political future, raising the risk of fresh parliamentary or presidential elections. But as we have said before, this is a domestic issue and likely one-off shock. Only if French government bonds start to disfunction along with other Europeans, then we may see a more pronounced sell-off in the single currency.

GBP was relatively flat with only the yen and euro impacted by political issues. That could be only a matter of time for the pound, with the clock ticking into the late November UK autumn budget. Cable also trades around its 50-day SMA, at 1.3462.

JPY got hit hard though did comes off its lows through the day on the surprise Japanese LDP election winner. As we have said several times, Takaichi is a fiscal and monetary dove, while she was unfancied by many polls into the weekend. That meant a sharp jump in USD/JPY to above 150, while Japanese stocks surged by nearly 5%. BoJ pricing of hikes has also been curbed, with just a 25% chance of one in October and now a coin toss in December. There is the risk of a snap election, while deals with other parties may be needed, which could limit the ‘Iron Lady’s’ policy moves.

AUD outperformed along with the kiwi, as they both enjoyed firmer stocks and risk sentiment, even with several headwinds. CAD lagged its peers as it has done for some time with the major consolidating in bullish fashion, though the 200-day SMA looms above at 1.3981.

US stocks: The S&P 500 gained 0.36% to close at 6,740, the seventh straight day in the green, and the 32nd record close of this year. The Nasdaq moved higher by 0.78% to settle at 24,979. The Dow Jones finished at 46,695, down 0.14%. Four sectors closed in the red with Real Estate lagging -0.99%. AMD’s chip supply deal with OpenAI boosted more tech buying, as investors remain highly enthused about ‘AI’ deals. The stock settled up 23.7% and there is increasing chatter that we are in a ‘bubble’ more broadly. The drought of government data could also be encouraging Fed rate cuts. Tesla jumped over 5.4% after it teased an October 7 event with hopes of more affordable model. Crypto stocks also pushed higher on the back of Bitcoin’s rally.

Asian stocks: Futures are mixed. Stocks traded mixed amid regional holiday closures and the uncertainty around the US government shutdown. The ASX 200 saw strength in commodity sectors offset by tech and healthcare losses. The Nikkei 225 surged to all-time highs on expectations of fiscal support and delays to BoJ policy normalisation. See below for more. The Hang Seng slid with the mainland on holiday for Golden Week.

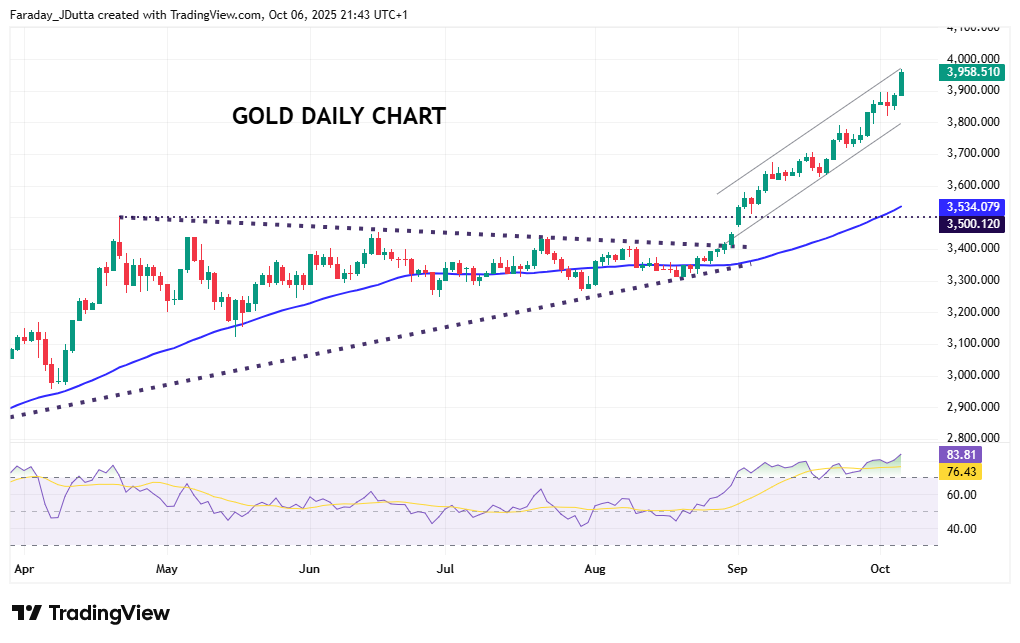

Gold surged again, up over 2% on the day, to new highs at $3,967 even with dollar and Treasury yield strength.

Chart of the Day – Gold eyes $4,000

It’s been interesting reading about ‘FOMO’ type behaviour in bullion as ETF holdings continue to grow. They now stand at their highest level since September 2022. The prolonged US shutdown has also fuelled investors’ demand for safe haven assets. The US disruption delayed the all-important non-farms payroll data which had been expected last Friday, further clouding an already uncertain economic outlook.

Gold is up nigh on 50% this year with two more 25bps Fed rate cuts virtually fully priced in for this year, helping attract more buyers. Two weeks ago, Goldman Sachs predicted the precious metal would rise to $4,000 by the middle of next year, on account of strong structural central bank demand and Fed easing, which supports ETF demand.