Gold suffers largest absolute drop on record

* Wall Street mostly flat after upbeat earnings from Coca-Cola and GM

* Gold and silver post steepest drops in years as rally cools

* Yen falls to one-week low after Takaichi elected as Japan PM, USD firms

* Netflix stock drops after earnings miss estimates, Tesla up next

FX: USD gained and closed near its highs for the day. Easing credit concerns, reinforced by solid regional bank results from Zion Bancorp probably helped the greenback. President Trump is due to meet Chinese counterpart Xi next week in South Korea. But the Putin/Trump rendez-vous is on hold. Trump repeated his positive comments about the Xi negotiations. Strong resistance on the DXY is around 99.57.

EUR fell for a third straight day and down to a major Fib level of the August to September move at 1.1592. Ukraine-Russia ceasefire chatter was squashed by a meeting between Presidents Trump and Putin being cancelled, according to news reports. The euro would get an obvious boost if some sort of peace truce came about. But tangible progress is needed on negotiations.

GBP eased modestly as markets look ahead to today’s inflation data. See below for more details. The 50-day and 100-day SMAs sit above at 1.3465 and 1.3482. Initial support resides below around 1.3330.

JPY was the major laggard with the major jumping higher on the confirmation of the new PM. A third day of losses for the yen sees bears eyeing up the recent high at 153.27 in USD/JPY. The Takaichi trade remains, though the new PM does not see the need to review the BoJ-Government accord for now, with monetary policy implementation staying with the bank.

AUD continued to consolidate around 0.65 with little news flow. CAD strengthened after the CPI report showed sticky price pressures which complicate the BoC outlook. The headline printed two-tenths above estimates at 2.4% with trimmed measures also higher. Food was the main driver of prices.

US stocks: The S&P 500 lost 0.01% to close at 6,735. The Nasdaq moved lower by 0.06% to settle at 25,127. The Dow Jones finished at 46,925, up 0.47% on the day. Only three sectors stayed positive with Consumer Discretionary, Industrials and Health leading the gains. ‘Old school’ defensives like Coca-Cola, GM, GE, RTX and Haliburton all broadly beat EPS and revenue estimates, which helped the Dow. Utilities, Communication Services and Materials lagged, with the latter hit by tumbling precious metal prices. Netflix suffered initial losses of 4% after its earnings release after the US close showed it missed profit expectations but blamed a tax dispute in Brazil. The streaming giant no longer reports its subscriber numbers but said it hit its highest quarterly view share ever in the US and UK.

Asian stocks: Futures are mixed. Stocks traded higher on the strong performance Stateside. The ASX 200 made more record highs with mining and resources sectors outperforming on the US agreement over critical minerals. The Nikkei 225 pushed up near to the 50k mark before fading. The certainty of Takaichi as the next PM also buoyed stocks. The Hang Seng and Shanghai Comp were higher amid hopes for better China-US relations.

Gold suffered its worst one-day drop in 12 years with its overdue sell-off seeing aggressive profit taking. There was heavy selling across the precious metals space with silver down over 7% and platinum over 6%. This move came after a $1,000 rally in just six weeks in bullion and a 25% gain in the past two months alone. Conditions were severely overbought with the move in the dollar and the lack of data on how investors are positioned in futures markets due to the government shutdown among other catalysts.

Day Ahead – UK CPI, Telsa earnings

September UK headline inflation is expected to tick up two-tenths to 4%, which would be the highest print since January 2024. That would match the MPC’s recent forecast. Core is predicted to rise one-tenth to 3.7% while services inflation is forecast to rise close to 5%, highlighting the persistent nature of UK price pressures. This is the final inflation data ahead of the November of BoE meeting which has updated quartely economic projections. Any undershoot is unlikely to be large enough to persuade the majority of MPC members to cut rates. A hotter report would price out the small chance of a rate reduction, with odds sliding for a February move too. That should underpin support for GBP.

Tesla is the first of the Mag 7 to report Q3 earnings, which come after the US close. Key areas to watch on the EV front include Q4 expectations for order trends after the US green credit ended. Gross margins excluding regulatory credits will be in focus too. Further out, energy storage profitability will be key for longer term aims while any more concrete figures and guidance on FSD and robotaxi would boost the stock. A steady capex and R&D plan could show discipline amid big ambitions.

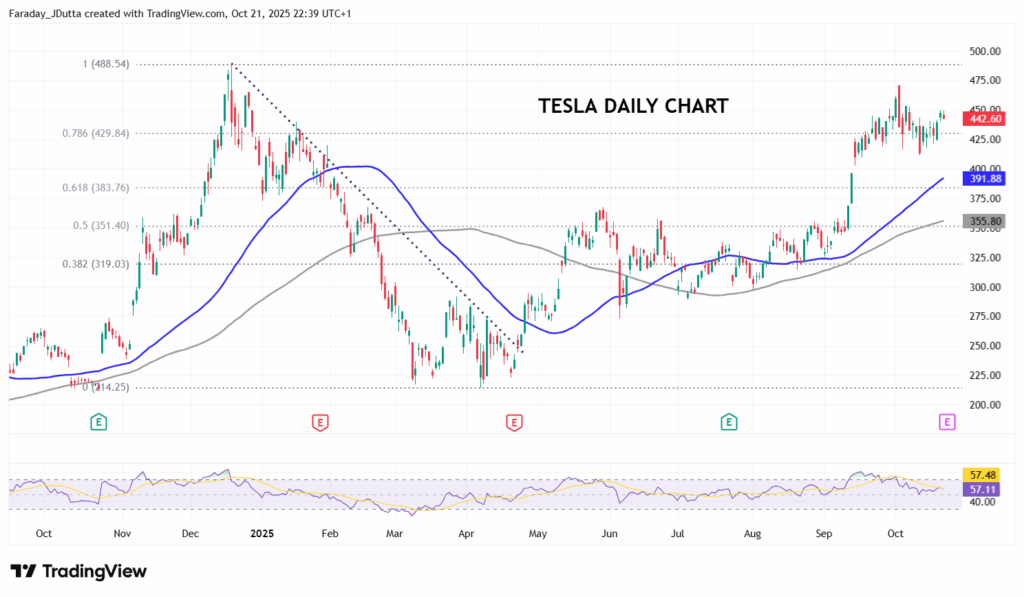

Chart of the Day – Tesla just below recent cycle highs

Consensus expects EPS at 50c, on revenues of $25.3bln. The stock has underperformed its peers and just about outperformed the broader market, with gains of 16.8% year-to-date. Better-than-expected Q3 delivery figures provided a boost in recent week with Elon Musk’s company TSLA standing as the 8th largest stock on both the S&P 500 and the Nasdaq 100. Options on the stock price see a move of +/-7.1% in the 24 hours following the release of results. We see the monthly candle is a wide doji at present with the October high at $470.75 and the record top at $488.54. Support is a minor Fib level of the December to April fall at $429.84 with the 50-day SMA some way below at $391.88.