USD up on Powell push back; META and MSFT tumble, GOOG soars

* Markets volatile after Fed cuts rates – but Powell won’t promise another

* Meta hit by huge AI spending while Alphabet rallies on record revenue

* Dollar rallies on hawkish Powell comments curbing more rate cut bets

* Confident Xi to meet Trump at tenuous time in US-China trade war

FX: USD went bid after the Fed meeting and expected rate cut but hawkish Powell. The statement emphasised differing views on the FOMC and more optimism on economic activity, while Powell’s key phrase was ‘a December cut is not a foregone conclusion, far from it.’ This reined in bets of another 25bps move at the last meeting of this year in December, which are now given around a 68% chance from above 90% before this meeting. Strong resistance sits at 99.57/51 with the swing high from August at 100.25. We had talked about two inside weeks on the Dollar Index potentially meaning we get a period of range expansion.

EUR ticked modestly higher before selling off after the Fed decision and sits under the 50-day SMA at 1.1686. Consensus is expecting a repeat of recent ECB language with policy in a ‘good place’ and a data dependent, meeting-by-meeting stance at today’s meeting. This relatively neutral stance contrasted with an expected dovish Fed, which was put into doubt with a more cautious Powell at the Q&A and the statement.

GBP was an underperformer again as cable broke down through the 200-day SMA at 1.3237. The August low sits at 1.3141 along with a major Fib level. Rate cut bets have ramped up this week with above a one in three chance of a move at next weeks BoE meeting, and above a 75% probability of a 25bp cut in December. Recent soft inflation and wage growth data has ignited chances of more policy easing with a foreboding about the upcoming budget.

JPY moved lower with the major up through the FOMC statement and Powell Q&A as Treasury yields moved higher. The yen mildly underperformed along with other havens before the Fed meeting. Strong resistance sits above 153 with initial support at 151.61 ahead of the BoJ meeting – more below.

AUD outperformed originally on hot inflation data which pointed at accelerating intra-quarter price pressures. The high chance of another rate cut by year end dropped sharply from roughly 90% to 25%. Prices spiked at 0.6617 before closing lower on the day. CAD was strong on the back of the hawkish BoC rate cut that we hinted may happen yesterday. The bank signalled that the new policy stance is ‘about right’ so a pause is likely in December, though risks are skewed to more action next year. Rate expectations were moving below a coin flip chance of a move in April. Trade news is obviously key going forward. Prices eventually bounced off the 50-day SMA at 1.3895 and retraced to the 200-day at 1.3947.

US stocks: The S&P 500 was flat, closing at 6,891 after making a new record intraday high at 6,920. The Nasdaq moved higher by 0.41% to settle at 26,120, another record close. The Dow Jones finished at 47,632, down 0.16% on the day. Real Estate, Consumer Staples, Materials and Financials were the big losers, while Tech, Communication Services and Energy were the outperformers. Nvidia was the talk of the Street as it crossed the incredible $5 trillion market cap line. The stock has more than doubled in value since the Liberation Day April lows, adding $2.5 trillion in market value. The milestone simply reinforces the fact that the chipmaker is the standout winner at this stage of the AI revolution, with the capex boom and new partnerships erasing any issues around circularity. After hours, Meta tumbled over 8%, Microsoft slid 3.3% while Alphabet jumped more than 6%. The latter was buoyed by cloud performance which underscored ongoing enterprise demand for AI workloads. Impressive capex figures beat estimates. But Meta’s numbers were not good enough and hurt by a huge earnings charge of $16bn. Microsoft also disappointed very high expectations with Azure failing to impress.

Asian stocks: Futures are mixed. Stocks were mainly positive after tech outperformance Stateside. The ASX 200 pulled back again, dragged down by healthcare, real estate and industrials weakness. The Nikkei 225 hit fresh record highs above 51,000 with tech buoyant. The Hang Seng was out on holiday, while the Shanghai Comp was in the green though volumes were thinner.

Gold bounced back initially after hitting a 3-week trough at $3,886 on Tuesday. Prices traded between a major Fib level (38.2) at $4,033 and the midpoint of the September low to record high is $3,925 for most of the day, before seeing selling during and after the Fed as yields and the dollar rose.

Day Ahead – BoJ and ECB Meetings, 2 of Mag 7 earnings

The BoJ will likely hold rates at 0.50%, amid political changes and updates to its GDP growth and inflation forecasts at this meeting. The economy has been resilient in the face of tariff headwinds. But the new PM is a monetary and fiscal dove who has ordered a package of economic measures to ease the impact of inflation on households. Markets are hopeful of policy hikes in December or January. There was the small chance of a double top in USD/JPY with firm resistance above 153 but the rebound through the FOMC meeting means momentum is mildly bullish again in the major.

The ECB is set to hold at 2.00%, maintaining the ‘good place’ policy stance. No major changes are expected until December’s fresh update of economic projections. Any signals from Lagarde on future cuts or commentary on eurozone stability will be watched. But it should be a relatively quiet meeting with a data dependent stance very likely as incoming economic figures are broadly in line with current ECB forecasts.

The next two Mag 7 stocks release their Q3 results after the US close, with Apple and Amazon worth a combined near $6.5 trillion. Amazon has struggled this year with its moderate growth outlook. Consensus EPS expectations are $1.57 on quarterly revenues of $177.7bln. Strong growth in its advertising business and cloud business (AWS) should be positives which will be monitored, but margins at AWS are under scrutiny as competition in cloud intensifies. Options price a move of +/-6% over the upcoming print. The September high is $238.85 with the 50-day SMA at $225.06.

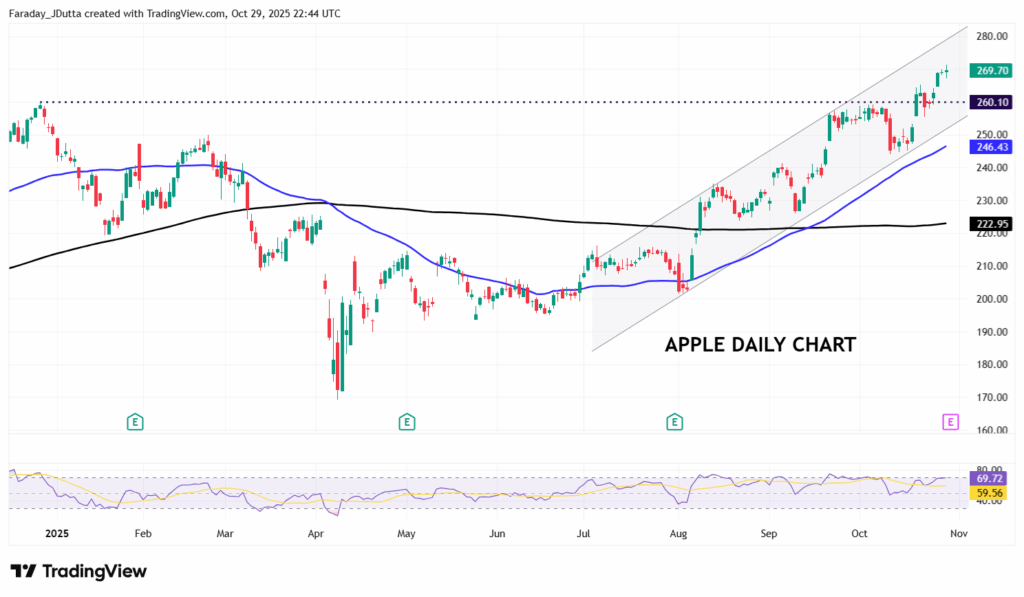

Chart of the Day – Apple just hit record highs

Apple heads into its earnings release having just hit a record high. But the stock had struggled this year before its positive iPhone 17 launch saw buyers return. The stock is now up just over 9% in 2025 so far, so underperforming the broader S&P 500. Consensus expects diluted EPS at $1.76, on revenues of $101.7bln. Apple has obvious strong product and services growth. But investors will be wary of tariff exposure and competition in China and in AI. Options imply a relatively modest move of +/-3.4% in the 24 hours following the upcoming report, though the stock has ended earnings day in the red following the last four consecutive reports. Prices are in a solid bull channel of higher highs and higher lows since early Summer. The December 2024 is a major swing high and previous resistance now support at $260.10.