Valuation worries hit tech as DXY breaks 100

* Dollar up on rate cut doubts and safety play, pound slips

* Wall Street ends lower amid bubble fears in stocks

* Palantir tumbles as nerves rise around frothy valuations

* Gold slips below $4000 on stronger dollar, awaits US jobs data

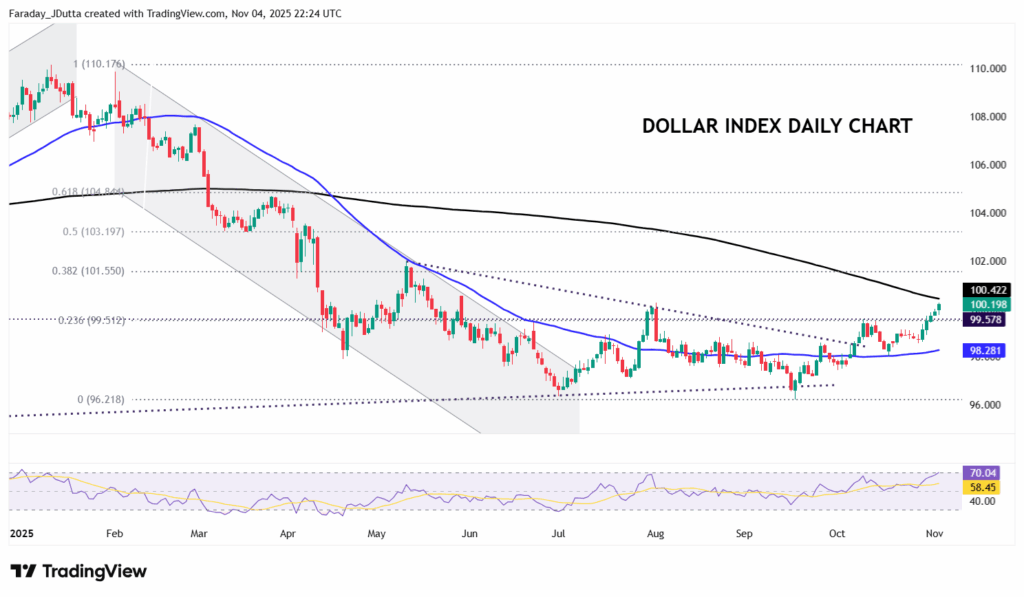

FX: USD moved higher for a fifth straight day and nears the widely watched 200-day SMA at 100.42. There have been mixed views from Fed officials, amid the ongoing US Government shutdown. Today sees the latest ADP employment change and ISM services print, while tomorrow we get the start of the hearing on the legality of US President Trump’s Reciprocal Tariff Policy. Risk sentiment was poor which may have aided the dollar as it crossed the 100 handle for the first time since August.

EUR moved lower for a sixth day in a row as it broke down through near-term support at 1.1504. Fundamental eurozone releases have been limited, and comments from the ECB have remained neutral. Relative central bank policy is the current driver, with last week’s hawkish Fed cut erasing some support for the euro in yield spreads.

GBP underperformed with cable down 0.98% and suffering its worst day since early September to levels not seen since April. The midpoint of this year’s rise is 1.2941. The catalyst was a pre-budget press conference given by the Chancellor Reeves. What may have been an attempt to appease and calm budget concerns seemingly failed. Reeves refrained from announcing specific measures or confirming if she’d make a U-turn on election promises, i.e. not to increase National Insurance, rates on income tax or VAT. Speculation increased and the pound tumbled, with three weeks still to go until the Budget.

JPY outperformed as its safe haven characteristics kicked in. They have been missing in recent months as markets focused on the domestic political uncertainty. There was also more commentary regarding FX intervention from the Japanese Finance Minister that added support. There is a minor fib (78.6%) of this year’s decline at 154.81 as next resistance. But we printed a bearish outside day so that warns potentially of some downside.

AUD tumbled, in the bottom three of majors versus the dollar. The aussie initially went bid after the RBA saw one cut in 2026 from the prior forecast of two. It also raised inflation projections. But the downbeat risk mood did for high beta currencies, with the kiwi down over 1.2% on the day to near 7-month lows. CAD outperformed its peers but not the greenback as the major beat the mid-October top at 1.4080, posting near 7-month highs. Governor Macklem said that monetary policy is somewhat “stimulative” but there were limits on what the BoC can do to offset the headwinds from trade turmoil.

US stocks: The S&P 500 lost 1.16%, closing at 6,773. The Nasdaq moved lower by 2.07% to settle at 25,436. The Dow Jones finished at 47,086, down 0.53% on the day. Only four sectors were in the green, with Consumer Staples and Financials leading the gains. Tech led the downside with Industrials, Communication Services and Consumer Discretionary all down over 1%. Two major US investment CEOs warned of a possible pullback in stocks, sparking tech bubble worries. Palantir was the headline grabber, as it eventually closed down 7.9% even though it beat on EPS and revenue. But as we said yesterday, it’s very richly valued trading at a forward p/e of 253x. Spotify also topped EPS and revenue with better than expected next quarter guidance, but closed 2.3% lower, having made intraday near 6-month lows. Apple finished higher on the day, the only megacap to do so, as it reportedly plans to launch a low-cost Mac laptop.

Asian stocks: Futures are mixed. Stocks were muted after mixed Wall Street performance. The ASX 200 was weaker led by minerals and utilities, ahead of the RBA on hold decision. The Nikkei 225 returned from the holiday long weekend and turned lower. The Hang Seng and Shanghai Composite was subdued on reports the Trump administration stopped Nvidia’s push to export AI chips to China.

Gold dropped over 1.7% as the dollar traded higher for a fifth straight day. Treasury yields. China announced the end of a tax rebate for some retailers, basically bringing an end to a VAT offset when selling gold that was bought from the Shanghai Gold Exchange. The move will essentially make bullion more expensive for Chinese consumers.

Day Ahead – ADP (US jobs data), ISM Services

The ADP employment change will be important as the only relevant data source on the job market Stateside, due to the government shutdown and dearth of economic data. Even though it has historically been a poor predictor for NFP over many years, more recently with NFP downward revisions, the ADP data has increased in accuracy. There’s been three negative numbers over the last four prints, but consensus looks for a reading of 30k. Policy uncertainty has been reduced while the negative effects from tightening financial conditions have eased. That said, big job loss announcements at major corporations like UPS, Amazon, Intel and Accenture do not bode well as Fed officials watch the labour market very closely.

Expectations are for a rise to 51.0 for October non-manufacturing ISM from the prior 50.0. S&P Global saw the second fastest growth in business activity this year, while jobs growth picked up too. The prices index is predicted to hover near the highest level since late 2022, which all means it’s a tough spot for the Fed with elevated risks to both sides of its mandate.

Chart of the Day – Dollar Index nears 200-day SMA

As we always remind ourselves in our weekly webinar, this index is dominated by the euro, which has around a 56% weighting. The next biggest is the yen with around 14%, and then sterling with around 12%. Prices looked to have bottomed out in mid-September at 96.21 with the move through the downward trendline from the May and August highs boosting bulls. The 50-day SMA at 98.28 acted as support and the index recently broke though resistance at a minor Fib level of this year’s decline at 99.51 and a major swing low from July 2023 at 99.57. We are now just below August highs at 100.25 with the 200-day SMA at 100.42 looming above. A major retracement level (38.2%) sits at 101.55.