An economic recession is a phenomenon that occurs every three and a half to six years on average[1].

In the mid-70s, recessions were marked by analysts as a decline in growth for at least two consecutive quarters. Today, a global recession is characterised by the simultaneous, sustained contraction of the world’s major economies[2]. Persisting for more than a few months, recessions are harmful to any nation’s gross domestic product (GDP), income, employment, and retail sales[3].

Key Points

- Recessions, occurring on average every 3.5 to 6 years, are periods of economic decline that can affect GDP, income, employment, and retail sales, leading to reduced consumer confidence and spending.

- Preparation for a recession can include diversifying investments with bonds and ETFs, exploring global markets, trading cautiously, and saving a substantial emergency fund to cover living and trading expenses.

- CFDs offer portfolio diversification across global markets and the ability to profit from both rising and falling markets, but come with higher risks, especially during the volatility of a recession.

Is it time to prepare for the next recession?

The last three years have seen COVID-19 and the Ukraine war bring the global economy to its knees. Shortages in essentials — from semiconductors and grains, to lumber and potatoes — are affecting millions worldwide on a daily basis[4].

Prices of everyday commodities have been skyrocketing due to inflation, which significantly hikes up the cost of living. This has then caused a drop in both consumer confidence and spending, followed by a nosedive in revenues and taxes.

Across the world, companies have trimmed down staff, and anxious investors have the stock market steeped in panic-induced underperformance. The S&P 500 is down 20% year-to-date, topping its lowest six-month start to a year since 1970 last 30 June. Further, the Dow Jones Industrial Average has plummeted 15%, while the Nasdaq Composite has fallen nearly 30% since 2022 started[5].

Recession and the business cycle

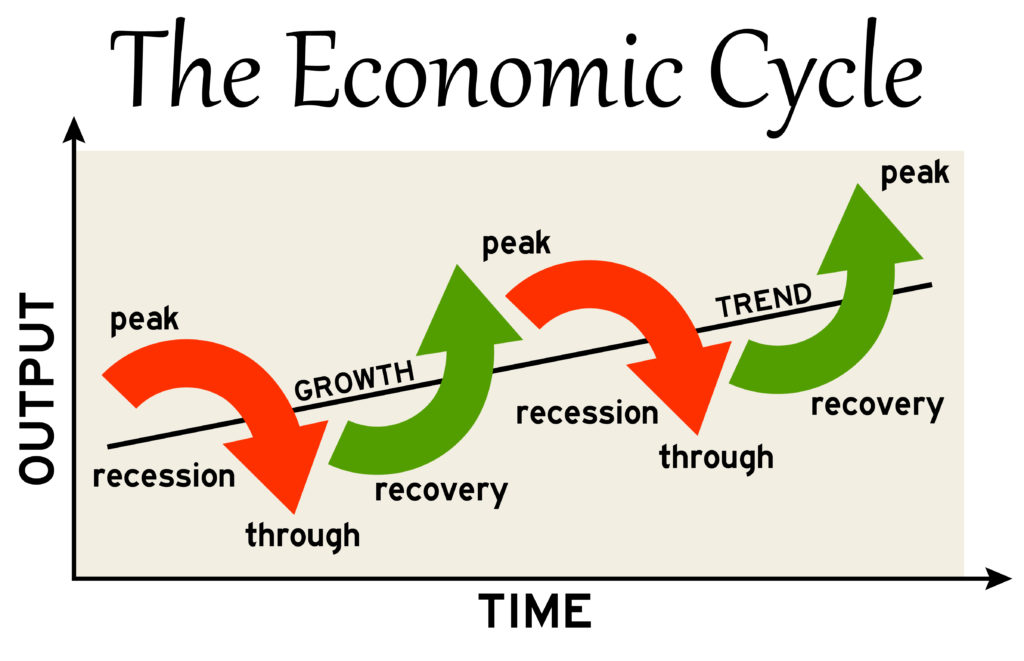

Per the business cycle, which tracks the movement of an economy over time, the world is in a typical recession phase.

Stage 1: Peak. The economy is at its healthiest. GDP, employment, incomes, and consumer spending are consistently growing. Stock prices, share prices, and even dividend payouts are at a premium.

Stage 2: Recession. GDP, employment, and income begin dwindling due to unforeseen events like war (Ukraine), reduced consumer spending (COVID-19), or a supply shock (COVID-19 and war-related shortages). Stock prices plunge, causing many investors to exit the market altogether. Because both worker wages and consumer prices are inelastic, companies cut more payrolls, and consumers spend even less.

Stage 3: Trough. GDP and employment reach their absolute rock bottom — then rise again. After an extended slump, businesses start bouncing back, stocks begin rallying, and both spending and investment pick up steam.

Stage 4: Recovery and expansion. The economy begins growing again, prompting firms to hire more workers and compete for labour. With more money in more people’s pockets, consumer spending is reinvigorated. Companies then charge more for goods and services, introducing inflation. Inflation usually debuts low and slow, but whenever it gets too high, it grounds economic growth to a halt. This starts the business cycle all over again[6].

What a recession can do to you

With the world economy currently sitting under the “impending recession” category, one must understand the obstacles this might bring.

- Recessions could affect your income stability and spending. Based on the business cycle, when the GDP continues to shrink, companies will likely cut corners on salaries and headcounts.

- Recessions affect the performance of your portfolio. While recessions can make markets extremely volatile, shares and stock prices plummet across the board at this time. Such conditions invariably cause the value of most portfolios to diminish, especially without effective intervention.

- Recessions affect the investments and trades you make. A recession affects different market sectors in different ways. For example, utilities hold up well during this phase, while real estate and industrials are hit the hardest[7].

How to prepare for a recession

- Consider bonds. In a booming economy, interest rates and stock prices are usually up, while bond prices are down. Conversely, recessions cause interest rates and stock prices to fall, causing bond prices to rise. When an economy is actively contracting, bonds can protect one’s investment better than stocks[8].

- Explore ETFs. Investing in exchange-traded funds (ETFs) is another good way to reduce recession risk through diversification. Funds tracking sectors like consumer staples and healthcare tend to outperform or stay strong during severe economic downturns. Other options are ETFs that track US Treasury bonds[9].

- Go global. Since recession affects different countries differently, looking beyond US and UK markets can help one’s portfolio in such times. Emerging markets will have unique growth trajectories and timelines, while foreign central banks will have targeted recession recovery strategies[10].

- Trade lean. It’s always wise to consider prioritising capital preservation and trade only what one can afford to lose. This does not ring truer than during recessions, as these periods are marked by extreme uncertainty. Sticking to a strict trading budget during this time helps protect financial solvency amid extended market underperformance[11].

- Save up. Recessions threaten job security and business stability across the board. Shoring up a minimum of 12-24 months worth of emergency savings is key in the event of a layoff. This safety net should be enough to cover not only monthly expenses, but also trading capital, as one strategises for the next career move.

- Trade gold. Consider trading gold as a recession strategy, given its status as a safe-haven asset that often appreciates during economic downturns. Investors can engage with gold through various channels, such as physical gold, gold ETFs, or gold mining stocks, to hedge against inflation and currency devaluation. Incorporating gold into your portfolio can provide stability and diversification in volatile economic times.

Enhancing Financial Literacy: A Strategic Approach to Navigating Recessions

Amidst the uncertainties of an impending recession, the importance of enhancing one’s financial literacy cannot be overstressed. A comprehensive understanding of financial principles and market dynamics equips investors with the tools necessary to navigate through periods of economic downturn effectively.

Exploring different investment choices, market trends, and past financial downturns can help investors make smarter and more informed decisions. Furthermore, understanding financial literacy gives investors the power to see both the potential risks and opportunities that come with recessions.

A solid educational foundation in finance is pivotal in developing a resilient and adaptable investment strategy, allowing individuals to not only safeguard their assets during challenging times but also to position themselves advantageously during a recession.

Looking for a place to improve your financial literacy? Head over to Vantage Academy, where you can dive into a wealth of free articles exploring a wide range of financial products. Gain the knowledge you need to make informed investment decisions.

Ready to take your understanding to the next level? Sign up for our free Vantage course today and solidify your foundation in finance literacy.

Building a recession-proof portfolio

Taking active measures to protect one’s portfolio can help shield oneself from the negative impact that recessions bring.

Diversifying one’s holdings is an option for keeping one’s portfolio well-balanced, as this spreads out and minimises recession-related risk. Plus, maintaining enough emergency funds to cover both day-to-day and trading activities is integral to surviving job loss from recession.

Further, Contracts for Difference (CFDs) provide an alternative means to prepare one’s portfolio for recession via diversification. CFDs are derivatives that let traders speculate on the movements of underlying assets, without buying said assets at spot price[12].

CFD traders make or lose profit by paying the differences in value of the underlying assets between their opening and closing positions. CFDs use leverage, allowing traders to trade on margin. This means, CFD traders pay only a fraction of the underlying asset’s market value, but can gain greater exposure for their opening position.

This same margin, however, also exposes CFD traders to higher risk. As recessions create immense market volatility, CFD traders can either make profits or losses, depending on their underlying assets and the timing of their positions.

Why CFDs may help you prepare for the next recession

Spanning a wide range of global markets and securities — from commodities to options, futures to forex, stock indices to ETFs — CFDs offer great diversity to one’s portfolio.

Moreover, CFD traders can make potential gains in both rising and falling markets, since they can speculate on an underlying asset’s price in either direction. For instance, if an asset like oil seems temporarily overvalued at any point in time, traders can use oil CFDs to potentially benefit from a fall in its price.

As with any other financial instrument, due diligence is highly desirable when dealing with CFDs. As always, understanding how the markets and its various elements behave, while tracking real-time data and analysis, is critical to keeping one’s portfolio recession-proof.

Start Trading with Vantage

Access markets including forex, commodities, indices, shares/stocks and more, at low cost.

Start trading CFD stocks by opening a live account here, or practice trading with virtual currency with a demo account.

You can also sign up for our free, weekly webinars that will break down the current markets as well as discuss potential trade set ups for the week.

Reference

- Burrows, D., & Waggoner, J . Recessions: 10 facts you must know. Kiplinger. Retrieved August 18, 2022, from . https://www.kiplinger.com/slideshow/investing/t038-s001-recessions-10-facts-you-must-know/index.html . Accessed 18 August 2022

- Hall, S. (n.d.). Explainer: What is a recession? World Economic Forum, from https://www.weforum.org/agenda/2022/07/global-economic-recession-meaning/ . Accessed 18 August 2022

- Rodeck, D. (2022, August 4). What is a recession? Forbes. from https://www.forbes.com/advisor/investing/what-is-a-recession/ . Accessed 18 August 2022

- Goodman, P. S., & Bradsher, K. (2021, August 30). The world is still short of everything. get used to it. The New York Times. from https://www.nytimes.com/2021/08/30/business/supply-chain-shortages.html . Accessed 18 August 2022

- Dore, K. (2022, July 2). Some experts say a recession is coming. here’s how to prepare your portfolio. CNBC. from https://www.cnbc.com/2022/07/02/some-experts-say-a-recession-is-coming-how-to-prepare-your-portfolio.html . Accessed 18 August 2022

- Investopedia. (2022, August 6). How do recessions impact investors? Investopedia. from https://www.investopedia.com/insights/recession-what-does-it-mean-investors/ . Accessed 18 August 2022

- Thune, K. (2022, March 7). Here are the best sectors for investing and stages in the economic cycle. The Balance. from https://www.thebalance.com/best-sectors-for-stages-in-economic-cycle-2466867 . Accessed 18 August 2022

- Amadeo, K. (2022, March 5). How bonds affect the stock market. The Balance. from https://www.thebalance.com/how-bonds-affect-the-stock-market-3305603 . Accessed 18 August 2022

- Moskowitz, D. (2022, August 4). 6 etfs to fight your recession jitters. Investopedia. from https://www.investopedia.com/articles/investing/041615/6-etfs-are-recessionproof.asp . Accessed 18 August 2022

- Walters, S. (2022, May 19). 3 reasons you need international stocks in your investment portfolio. The Motley Fool. from https://www.fool.com/investing/2022/05/19/3-reasons-you-need-international-stocks-in-your-in/ . Accessed 18 August 2022

- Why invest internationally? Vanguard. (n.d.). from https://investor.vanguard.com/investor-resources-education/understanding-investment-types/why-invest-internationally . Accessed 18 August 2022

- Oil cfds: How it works and how to trade | vantage. (n.d.). from https://www.vantagemarkets.com/academy/cfd-oil/ . Accessed 18 August 2022