The opening bell in New York rings just as trading winds down in London, while Tokyo prepares for the next day’s session. Knowing what time the stock market opens in each region helps connect these moments, revealing how activity in one market can influence another. Across continents, each exchange follows its own schedule, shaped by time zones, local regulations, and cultural customs.

From the high-energy floors of Wall Street to the bustling markets of Hong Kong and Sydney, every trading day brings its own rhythm. Understanding global stock market hours and holidays can help you follow market movements more closely, spot cross-session trends, and stay connected to the flow of international finance.

Key Points

- Liquidity and volatility are highest during major market overlaps, especially the London–New York session.

- Opening hours often deliver the most significant price movements as markets react to fresh news and data.

- Extended trading hours provide additional opportunities but typically with lower liquidity.

What Are Stock Market Trading Hours?

Stock market trading hours are the specific times when exchanges are open for buying and selling securities. They determine what time the stock market opens and what time the stock market closes each day.

These hours vary across regions due to time zones, local regulations, and cultural practices.

Because world stock markets operate on staggered schedules, one market may be closing while another is opening — creating opportunities across the global stock market.

Knowing when the stock market opens and closes can provide educational insight into typical market activity, particularly during overlapping sessions.

Why Do Stock Market Hours Differ?

The variation in stock market hours comes from:

- Time zones – Exchanges follow their local business hours.

- Local regulations – Market authorities set specific trading times.

- Lunch breaks – Common in the Asian stock market, such as Tokyo and Shanghai.

- Extended hours – Offered by markets like the NYSE and NASDAQ to trade outside normal times.

These factors mean that when markets open in Asia, Europe, and the US, different trading opportunities emerge throughout the 24-hour cycle.

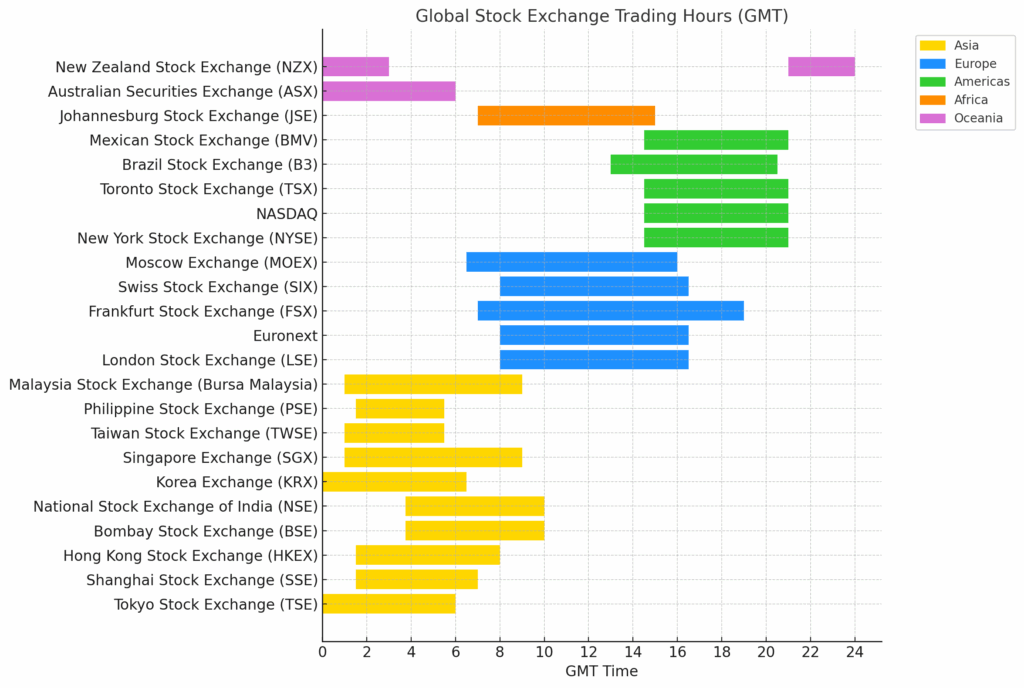

Key Global Stock Market Trading Hours

Understanding stock market trade hours can provide an educational view of typical market activity across regions.

Here’s a quick overview of the trading hours of some major exchanges:

| Stock Exchange | Region | Local Trading Time | GMT Trading Time | Lunch Break |

| Tokyo Stock Exchange (TSE) | Asia | 09:00–15:00 | 00:00–06:00 | Lunch 11:30–12:30 |

| Shanghai Stock Exchange (SSE) | Asia | 09:30–15:00 | 01:30–07:00 | Lunch 11:30–13:00 |

| Hong Kong Stock Exchange (HKEX) | Asia | 09:30–16:00 | 01:30–08:00 | Lunch 12:00–13:00 |

| Bombay Stock Exchange (BSE) | Asia | 09:15–15:30 | 03:45–10:00 | No |

| National Stock Exchange of India (NSE) | Asia | 09:15–15:30 | 03:45–10:00 | No |

| Korea Exchange (KRX) | Asia | 09:00–15:30 | 00:00–06:30 | No |

| Singapore Exchange (SGX) | Asia | 09:00–17:00 | 01:00–09:00 | No |

| Taiwan Stock Exchange (TWSE) | Asia | 09:00–13:30 | 01:00–05:30 | No |

| Philippine Stock Exchange (PSE) | Asia | 09:30–13:30 | 01:30–05:30 | No |

| Malaysia Stock Exchange (Bursa Malaysia) | Asia | 09:00–17:00 | 01:00–09:00 | No |

| London Stock Exchange (LSE) | Europe | 08:00–16:30 | 08:00–16:30 | No |

| Euronext | Europe | 09:00–17:30 | 08:00–16:30 | No |

| Frankfurt Stock Exchange (FSX) | Europe | 08:00–20:00 | 07:00–19:00 | No |

| Swiss Stock Exchange (SIX) | Europe | 09:00–17:30 | 08:00–16:30 | No |

| Moscow Exchange (MOEX) | Europe | 09:30–19:00 | 06:30–16:00 | No |

| New York Stock Exchange (NYSE) | Americas | 09:30–16:00 | 14:30–21:00 | No |

| NASDAQ | Americas | 09:30–16:00 | 14:30–21:00 | No |

| Toronto Stock Exchange (TSX) | Americas | 09:30–16:00 | 14:30–21:00 | No |

| Brazil Stock Exchange (B3) | Americas | 10:00–17:30 | 13:00–20:30 | No |

| Mexican Stock Exchange (BMV) | Americas | 08:30–15:00 | 14:30–21:00 | No |

| Johannesburg Stock Exchange (JSE) | Africa | 09:00–17:00 | 07:00–15:00 | No |

| Australian Securities Exchange (ASX) | Oceania | 10:00–16:00 | 00:00–06:00 | No |

| New Zealand Stock Exchange (NZX) | Oceania | 09:00–17:00 | 21:00–03:00 | No |

Some markets, like the NYSE and NASDAQ, offer extended trading hours before and after regular sessions. These extended hours allow traders to respond to news and events that may impact prices outside of standard trading times.

These schedules provide educational insight into global market activity, with liquidity and volatility often peaking during overlapping trading sessions.

Key Stock Market Overlaps and Why They Matter

When stock market open times overlap, trading activity increases. This leads to higher liquidity and tighter spreads, often associated with higher liquidity and narrower spreads.

| Overlap | Time (GMT) | Features |

| London–New York | 12:00–16:00 | High liquidity; active in equities, forex, and Dow Jones after-hours impact. |

| Tokyo–London | 07:00–08:00 | Active currency moves, especially GBP/JPY. |

| Sydney–Tokyo | 00:00–01:00 | Strong Asian share market influence, active AUD and JPY pairs. |

Regional Stock Market Hours

While the earlier table provides a full overview of global trading schedules, it can also be helpful to view key exchanges by region. This breakdown highlights when major markets open and close locally, giving a clearer picture of how each trading session fits into the 24-hour market cycle.

Asia

Asia’s markets often set the tone for global trading, with early moves influencing sentiment in Europe and the US.

- Tokyo Stock Exchange (TSE): 09:00–15:00 JST (lunch 11:30–12:30).

- Shanghai Stock Exchange (SSE): 09:30–15:00 CST (lunch 11:30–13:00).

- Hong Kong Stock Exchange (HKEX): 09:30–16:00 HKT (lunch 12:00–13:00).

Europe

European trading sessions are closely monitored for their overlap with both Asian and US markets, as these periods can coincide with higher trading activity and notable market participation.

- London Stock Exchange (LSE): 08:00–16:30 GMT.

- Euronext: 09:00–17:30 CET.

- Frankfurt Stock Exchange (FSX): 08:00–20:00 CET.

Americas

US markets play a central role in global finance, with activity peaking during the London–New York overlap.

- New York Stock Exchange (NYSE): 09:30–16:00 ET, pre- and post-market trading available.

- NASDAQ: 09:30–16:00 ET, with extended hours.

- Brazil Stock Exchange (B3): 10:00–17:30 BRT.

Africa

Africa’s largest exchange serves as a gateway to emerging market opportunities on the continent.

- Johannesburg Stock Exchange (JSE): 09:00–17:00 SAST.

Oceania

Oceania’s sessions are among the first to open each trading day, influencing early sentiment in Asia.

- Australian Securities Exchange (ASX): 10:00–16:00 AEST.

- New Zealand Stock Exchange (NZX): 09:00–17:00 NZST.

Extended Trading Hours and Public Holidays

Markets like NYSE and NASDAQ offer:

- Pre-market: 04:00–09:30 ET

- After-hours: 16:00–20:00 ET

Always check the New York Stock Exchange and other stock market holidays to see if the market is open or closed today.

Periods of High Market Activity (Educational Overview)

Market activity, liquidity, and price movement tend to peak at certain times during the day. Observing these periods can provide educational insights into typical market behavior.

One of the most active windows is when markets open in major financial hubs. The first hour after market open often exhibits heightened volatility, which can be observed for educational purposes. For example, the NYSE opening at 09:30 ET typically coincides with notable market movements.

Another key period is during overlapping sessions. The London–New York overlap, between 12:00 and 16:00 GMT, is widely regarded as the most liquid period in the trading day. During this period, trading activity is generally higher, which can be observed for educational purposes. This overlap may coincide with notable movements in major indices such as the S&P 500 and FTSE 100.

In the Asian stock market, activity tends to spike when the Tokyo Stock Exchange and Hong Kong Stock Exchange are both open. This overlap often sets the tone for the day ahead in global equities and can influence early moves in the European session.

Finally, traders should monitor extended trading hours, especially if they are reacting to after-market earnings, geopolitical events, or major news releases. While these periods typically have lower liquidity, they can present opportunities for those prepared to manage the additional volatility.

Trade Global Share CFDs with Vantage

Understanding stock market trading hours is essential for staying in sync with global market activity. From early moves in the Asian session to the high-liquidity London–New York overlap, each trading window presents distinct characteristics that can shape price action and market sentiment.

By knowing when major exchanges open and close, you can better anticipate periods of volatility and align your trading schedule with the sessions most relevant to your market focus.

Sign up for a Vantage account today to trade Global Share CFDs and access markets at your convenience. Vantage provides access to global markets, allowing you to explore market activity across different trading sessions for educational purposes. CFDs involve significant risk, and you should ensure you understand these risks before trading.

FAQs

What time does the stock market open?

Stock market opening times vary by exchange and region. For example, the New York Stock Exchange (NYSE) and NASDAQ open at 09:30 Eastern Time (14:30 GMT), while the London Stock Exchange opens at 08:00 GMT.

In Asia, the Tokyo Stock Exchange begins trading at 09:00 Japan Standard Time (00:00 GMT). Checking the specific schedule for your target market is important, as opening hours can influence trading activity and price movements.

What time does the stock market close?

Like opening times, closing times depend on the exchange. The NYSE and NASDAQ close at 16:00 Eastern Time (21:00 GMT), while the London Stock Exchange ends trading at 16:30 GMT.

In Asia, the Hong Kong Stock Exchange closes at 16:00 Hong Kong Time (08:00 GMT). Knowing the market’s closing time is useful for planning trades, especially around end-of-day volatility.

What are the stock market trading hours?

Stock market trading hours refer to the set times when an exchange is open for buying and selling securities. These hours differ between regions due to time zones, regulations, and cultural practices.

Some exchanges, such as the NYSE and NASDAQ, also offer pre-market and after-hours sessions, allowing trading outside regular hours. Traders often monitor these schedules closely to identify periods of higher liquidity, such as when major markets overlap.