- Trading

Trading

-

CFD Trading

What is CFD Trading How to Trade CFD Why Trade CFD CFD Trading Strategies

- All Trading Products

-

Markets

All Instruments Forex CFDs Indices CFD Commodities CFD Stocks CFD ETFs CFD Bonds CFD Cryptocurrency CFDs

- Trading Accounts

- Trading Fees

- Trading Leverage

- Trading Server

- Deposit & Withdrawal

- Premium Services

-

CFD Trading

- Platforms

- Academy

- Analysis

- About

-

AllTradingPlatformsAcademyAnalysisAbout

-

Search query too short. Please enter a full word or phrase.

-

Keywords

- Trading Accounts

- TradingView

- Trading Fees

Popular Search

- Trading Accounts

- MT4

- MT5

- Professional Trading Accounts

- Academy

Cryptocurrencies are reshaping the financial landscape by enabling faster, decentralised transactions without relying on traditional intermediaries. From peer-to-peer payments to investment opportunities, digital assets such as Bitcoin and Ethereum continue to gain mainstream adoption. Understanding how cryptocurrency works is a key first step in exploring its potential across trading, finance, and emerging technologies.

What Is Crypto? Meaning and Definition

Cryptocurrency is digital money secured by blockchain technology. Unlike traditional currencies like the Australian dollar, crypto operates on a decentralised network without central banks or governments. You can trade cryptocurrencies such as Bitcoin, Ethereum, or Ripple using fiat currencies like AUD or USD.

Many traders also use CFDs (Contracts for Difference) to speculate on price movements without owning the actual coins. While crypto markets offer exciting opportunities, they are highly volatile and require careful strategy and ongoing market awareness.

How Does Cryptocurrency Work?

Cryptocurrency functions through a combination of technologies and processes that ensure secure, transparent, and decentralised transactions. At its core, cryptocurrencies rely on blockchain technology—a distributed ledger that records all transactions across a network of computers worldwide. This system removes the need for banks or intermediaries.

To understand how cryptocurrencies operate in practice, it helps to break down key components:

- How transactions are recorded and verified (mining or validation).

- How users buy, sell, and store cryptocurrencies safely.

- The decentralised framework that governs the network and protects users.

What Is Blockchain?

Blockchain is a secure, immutable digital ledger that records every cryptocurrency transaction publicly and transparently. Its decentralised nature prevents fraud and manipulation, making crypto trustworthy.

What is Cryptocurrency Mining

Cryptocurrency Mining is the process where miners use powerful computers to solve complex problems that verify transactions. Successful miners earn cryptocurrency rewards, which also helps secure the network and keep the blockchain tamper-proof.

Buying, Selling, and Storing Cryptocurrency

Cryptocurrencies are bought and sold mainly on exchanges or through brokers. Once acquired, they are stored in digital wallets—either hot wallets connected to the internet for easy access, or cold wallets stored offline for enhanced security.

Decentralised Nature of Cryptocurrency

Because cryptocurrencies operate on decentralised blockchains, transactions don’t rely on banks or governments. This democratises financial services, lowers costs, and improves access worldwide.

Types of Cryptocurrencies

The cryptocurrency market has grown exponentially, with thousands of currencies now available. These digital assets are grouped into categories based on their purpose and utility.

Popular Cryptocurrencies

Here is a brief overview of some key cryptocurrencies:

- Bitcoin: The first and largest cryptocurrency, often called digital gold, limited to 21 million coins.

- Ethereum: Known for smart contracts powering decentralised applications.

- Tether (USDT): A stablecoin pegged 1:1 to the US dollar, widely used for trading.

- USD Coin (USDC): Another US dollar-backed stablecoin known for transparency.

- Binance Coin (BNB): Used within the Binance ecosystem for fees and governance.

Other Types of Cryptocurrencies

- Central Bank Digital Currency (CBDC): Digital currencies issued by governments, like Australia’s proposed digital dollar.

- Stablecoins: Cryptos designed to maintain stable value by backing assets.

- Virtual Currencies: Digital tokens used mainly in specific platforms or communities, often lacking decentralisation.

*Important Note: It’s important to understand that not all cryptocurrencies are virtual currencies, though the terms are sometimes used interchangeably.

Why Trade Cryptocurrency?

Cryptocurrency trading offers unique advantages that set it apart from traditional financial markets. Here are some of the main reasons why more traders are entering the crypto space:

Diverse Trading Options

CFDs allow traders to profit from price movements without owning the underlying coins, making it possible to trade in both rising and falling markets.

Market Independence

Crypto markets often move independently from traditional assets like stocks and bonds, providing valuable diversification for investment portfolios.

Accessibility and 24/7 Trading

Cryptocurrency markets operate 24 hours a day, 7 days a week, enabling trading at any time from anywhere in the world.

Innovative Technology

Blockchain technology underpins crypto trading, offering secure, transparent transactions and supporting ongoing financial innovation.

Is Cryptocurrency Safe? Common Risks and How to Stay Protected

While cryptocurrency presents new financial opportunities, it also comes with risks that traders and investors should be aware of. From price fluctuations to cyber threats, understanding these challenges is essential for navigating the crypto market securely. This section outlines common risks and practical steps to enhance safety when engaging with digital assets.

Common Risks in Cryptocurrency

Despite its innovative design, cryptocurrency trading and storage can expose users to various threats. These include market-related risks and security concerns such as fraud and theft. Recognising these risks is crucial for building a safer crypto experience.

Market Volatility

Cryptocurrencies are known for extreme price swings, often driven by speculation, regulatory news, or global events. This volatility can lead to significant gains and substantial losses within short time frames. Traders need to be cautious and understand the factors that move crypto prices.

Scams and Fraud

The crypto space has seen a rise in fraudulent schemes, including fake investment platforms, phishing scams, and Ponzi schemes. These scams often promise unrealistic returns or impersonate legitimate companies. Without proper due diligence, users risk losing their funds to deceptive actors.

Hacking and Theft

Cyberattacks targeting exchanges, wallets, and users remain a serious concern in the crypto ecosystem. Hackers exploit vulnerabilities to gain unauthorised access to digital assets, often resulting in significant financial loss. While most crypto transactions are recorded on the blockchain and traceable, recovering stolen funds can be complex and rarely guaranteed.

How to Stay Protected When Using Cryptocurrency

While risks cannot be completely eliminated, there are practical ways to reduce exposure and trade more securely. Implementing strong security practices and choosing trustworthy platforms are key steps in protecting your digital assets.

Trade through regulated brokers

Using a regulated broker ensures compliance with financial standards and adds a layer of consumer protection. These brokers are subject to oversight by financial authorities, which helps safeguard client funds and maintain transparency. Choosing a regulated provider may also offer recourse in the event of disputes or operational failures.

Use reputable exchanges and wallets

Selecting a well-established exchange or wallet provider with a solid security track record can significantly reduce the risk of hacks and fund loss. Look for platforms that offer cold storage, regular audits, and insurance options. Avoid using services with limited information or unclear ownership structures.

Enable two-factor authentication (2FA)

Two-factor authentication adds an extra layer of security to your crypto accounts by requiring a second form of verification during login. This can help prevent unauthorised access even if your password is compromised. Most major exchanges and wallets support 2FA through mobile apps or authentication tokens.

Trade Cryptocurrency CFDs with Vantage

The crypto market has grown rapidly, and platforms have improved to match traditional markets. While exchanges offer spot trading, Vantage lets you trade cryptocurrency CFDs — speculating on price movements without owning the coins.

With CFDs, you profit if the price moves your way, but losses can also be amplified, especially with leverage. That’s why risk management is key. Vantage provides Australian traders a secure, regulated platform with competitive spreads and advanced tools for confident crypto CFD trading.

How to trade Crypto CFD with Vantage

Vantage simplifies trading CFDs through an intuitive flow:

- Open the browser of your choice and log in at https://protrader.vantagemarkets.com/. Alternatively, you can open a Live Account to begin trading

- After opening the trading account, navigate to the right side of your screen to see available assets. Use the dropdown menu to navigate to cryptocurrencies.

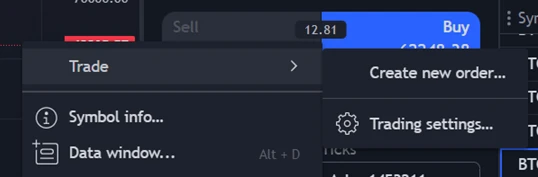

- Right-clicking on the charting area lets you open trades through a menu as shown below:

- The trading menu lets you trade using different order types like market, limit, and stop.

The trading panel enables the setting of take profit and stop loss thresholds according to your strategic trading analysis. Furthermore, users may utilise indicator presets to evaluate the asset’s historical performance, thereby facilitating informed decisions regarding forthcoming trades.

Try these next:

1. Why Trade Cryptocurrency

Explore the key benefits of trading cryptocurrency, from market accessibility to high volatility and diversification opportunities.

2. How to Trade Cryptocurrency

Learn the step-by-step process of trading cryptocurrencies, including choosing a platform, placing orders, and managing risk.

3. Cryptocurrency Trading Strategies:

Discover popular trading strategies for crypto, including trend-following, swing trading and position trading, tailored for different market conditions.

Frequently Asked Questions About Crypto

-

1

How is crypto different from traditional money?

Cryptocurrency differs from traditional money in that it is entirely digital and decentralised. Unlike government-issued currencies like the Australian dollar, crypto operates on peer-to-peer blockchain networks without a central authority like a bank.

Transactions are secured through cryptographic algorithms and recorded transparently on public ledgers, offering greater autonomy and global accessibility.

-

2

How much does one Bitcoin cost?

The price of one bitcoin constantly changes and is determined by supply and demand on cryptocurrency exchanges. Bitcoin is highly volatile, meaning its value can fluctuate significantly within short periods. To find the current price, you can check reliable trading platforms or financial news sources that track real-time market data.

-

3

Is trading crypto legal in Australia?

Yes, trading cryptocurrency is legal in Australia. The Australian Securities and Investments Commission (ASIC) regulates platforms that offer crypto-related financial products such as CFDs. Individuals can legally buy, sell, and trade crypto through registered exchanges, provided they comply with anti-money laundering (AML) and know-your-customer (KYC) requirements.

-

4

Is cryptocurrency trading safe for beginners?

Cryptocurrency trading is accessible to beginners, but it involves a high level of risk due to market volatility and the complexity of digital assets. New traders should understand how the market works, assess potential risks, and consider starting with demo accounts or smaller trade sizes.

Beginners can visit the Vantage Academy to access educational resources on crypto trading fundamentals, risk management, and trading strategies. Choosing a reputable and regulated platform like Vantage and sound risk management practices can help create a more secure and informed trading environment.

-

5

How do I keep my crypto safe?

Keeping your crypto safe involves using secure storage methods and trusted service providers. Cold wallets (offline storage) are considered one of the safest options for long-term holdings, while reputable exchanges offer security features such as two-factor authentication (2FA).

It’s also important to avoid sharing private keys, be cautious of scams, and regularly update passwords to enhance protection.