BoJ and RBA to kick off central bank meeting week

Headlines

* US stocks stumble late on but still post strong day ahead of FOMC

* BoJ set for hyped-up meeting with several leaks hinting at end of NIRP

* RBA likely to maintain hawkish bias though downside risks possible

* China data surprises with better retail sales and industrial production

FX: USD traded up for a third straight day ahead of numerous risk events. Treasury yields carried on moving higher too. The 10-year is up for a sixth consecutive day and very close to major resistance around 4.35%.

EUR sold off again after a pause on Friday and a doji candle after its sharp sell-off on Thursday. Final eurozone CPI showed no surprises at 2.6% y/y. Data this week includes two German business surveys (ZEW and IFO) plus Thursday’s PMIs. There are several ECB speakers including President Lagarde on Wednesday. Trend signals in the major are fairly neutral though turning mildly down.

GBP continued lower for a third day in a row. A well-watched UK house price index rose at the quickest pace in 10 months. A modest recovery in the housing market is evident and highlights the brightening confidence in the economy and peak in the BoE rate cycle. Support is 1.27, resistance 1.2765 in the near term.

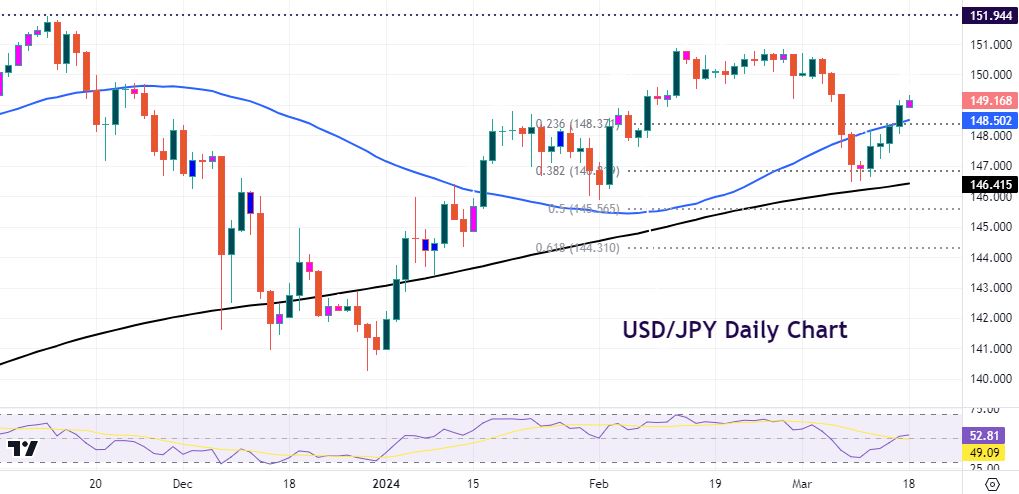

USD/JPY continued higher above 149. Focus is on the BoJ meeting in a few hours. Markets price in near enough a 50% chance of a 10bp hike. But economists do not predict a tightening move, with most seeing April as more likely.

AUD is trading around the midpoint of the Q4 rally at 0.6571 and the 200-day SMA just below at 0.6558. Attention turns to today’s RBA meeting where no changes are expected and on balance, a hawkish bias is still seen as likely. USD/CAD moved above 1.35 with Canada CPI in focus tomorrow. This data is expected to see an uptick in both headline and core inflation.

Stocks: US equities closed higher as AI positivity trumped concerns over rising yields ahead of Wednesday’s FOMC meeting. The broad-based benchmark S&P 500 closed 0.63% higher at 5,149. The tech-laden Nasdaq 100 added 0.99% to finish at 17,985. The Dow Jones settled 0.20% up at 38,790. Tech heavyweights, Apple and Alphabet gained 0.6% and 4.6% respectively on news of Apple integrating Google’s Gemini AI engine into the iPhone. Tesla’s shares surged over 6% after the announcement of price increases on its Model Y in some European countries. Nvidia closed higher by 0.7% ahead of its developer’s conference.

Asian futures are mixed. APAC stocks traded mixed after a quiet news weekend. Markets are readying themselves for the big week of central bank meetings. Better-than-expected China data including retail sales and industrial production saw Shanghai trade in the green. The Nikkei outperformed, helped by a softer yen and yields.

Gold remains in consolidation mood just above the previous long-term high from December at $2148. This pause for breath is easing overbought conditions after the parabolic move to record highs at $2195 a few weeks ago. All eyes are on the Fed meeting and whether we see a more hawkish dot plot or language by Chair Powell.

Day Ahead – BoJ and RBA

Will it or won’t it? Markets see the BoJ as too close to call for a long-awaited 10bp rate hike. We’ve seen numerous local media reports suggesting a hike will come. But consumption is weak, the latest national CPI data is released on Friday, and we’ve heard mixed comments from BoJ officials. Governor Ueda stated that confidence has grown in the achievement of the price target, but he recently stressed data dependency. Of course, the latest wage negotiations were agreed on Friday with the deal being the highest in decades, above 5%.

The RBA has been on hold after last hiking rates back in November. Policymakers considered hiking again at both of their subsequent meetings but decided against it. We’ve seen some further progress in bringing down inflation since the last gathering, particularly in the underlying measures. That means the meeting does carry some downside risks to AUD. But the hawkish bias under Governor Michelle Bullock is expected to stay, even though her most recent comments sounded slightly more optimistic about inflation coming down. We also note the RBA’s lower policy rate compared to other major central banks and the lingering risks of a rebound in inflation which has seen a repricing in global rate cut expectations.

Chart of the Day – USD/JPY not biting to media reports

It’s a coin toss / binary event for the chance of a 10bp rate hike. That should be accompanied by the end of yield curve control if it does happen. But the BoJ may keep its bond-buying programme to calm bond market volatility. If there is no rate move, it could be a “hawkish hold” as the bank lines up an April move with tweaks to the language. What happens next will also be important, as markets have already priced in more rate hikes. But the BoJ may want to signal this is a one-off move.

Interestingly, amid all the clamour and local media reports of an imminent, historic rate hike, USD/JPY has advanced for five straight days as US Treasury yields have continued to move higher. Prices moved above the 50-day SMA at 148.50 on Friday. No move could see the major closer towards 150 unless there is strong, hawkish language signposting an April hike. Support is the 38.2% retracement level of this year’s rally at 146.85.