Dollar ditched ahead of expected dovish FOMC

* Wall Street lets off a little steam with Fed in focus

* Dollar edges to four-year low vs euro as Treasury yields drop

* Gold settles at new record high as rate cut hopes pressure USD

* Fed expected to cut rates by 25bps, focus on tone and new dot plot

FX: USD carried on in defensive mode as the Dollar Index sold off aggressively through a long-term upward trendline from the 2011 and 2021 lows. It was the biggest one-day move lower since 1st August. The recent multi-year bottom seen in early July sits at 96.37. After some uncertainty, it now appears that current Fed official Cook and new member Mirin will be voting at today’s FOMC meeting. The latter avoids any major shock for now to the central bank’s independence. The high possibility of dovish dissent will be watched, plus the general tone of the statement and Chair Powell in the press conference. See more below. Retail sales in August came in hotter across the board highlighting the resilient US consumer. That saw the Atlanta Fed GDPNow Q3 figure revied higher to 3.4% form 3.1%. This should dampen any hope of a 50bps rate cut, which markets currently give a 4% chance.

EUR was a big outperformer, just below CHF, as it broke to new multi-year highs at 1.1878 before modestly paring some gains. Better than expected German ZEW business sentiment initially helped the euro. This is seen as a leading indicator for German industrial production. Yield spreads continue to be a support for EUR, with moderating ECB interest rate easing expectations contrasting with the Fed. Of course, all eyes are on the FOMC meeting.

GBP was mid-pack of the majors, printing another fresh cycle high at 1.3671 on broad dollar weakness and ahead of President Trump’s visit to the UK. UK jobs figures were largely in line, with nothing much to move Thursday’s unchanged BoE rate decision. The biggest fall in private sector workers outside of the pandemic is forecast by economists to take wage growth below 4% by year end. Today’s CPI data will be watched, but more for the November meeting, with services inflation likely to ease.

JPY outperformed most of its peers with yen gains driven by domestic political news on the LDP leadership race. The entrance of Koizumi, son of the former PM, is yen positive as he is seen as more respectful of BoJ independence than his competitor, Takaichi. Her views on loose monetary and fiscal policy are yen bearish. The 100-day SMA is below at 146.13, which is near the spike lows in mid-August.

AUD made was more subdued than its peers, corresponding with the similar risk mood. That said, the aussie did still push on to fresh cycle highs towards 0.67. CAD strengthened in line with its major peers versus USD again with the major dipping below the 50-day SMA. Focus is on the BoC and an expected rate cut. Headline and core CPI data was softer than forecast but the average of the three measures which is the bank’s preferred gauge rose.

US stocks: The S&P 500 lost 0.13% to close at 6,607. The Nasdaq slid by 0.08% to settle at 24,274. The Dow Jones finished at 45,758, down 0.27%. Sectors were mixed with Utilities suffering heavily, and Real Estate, Tech, Materials, Industrials and Financials also in the red. Energy was the clear outperformer as WTI crude jumped over 2% on the day. Alphabet, Google’s parent hit another record high at $253.23 but closed marginally lower on the day. The SOX (semiconductor index) hit an intraday record, its fourth in five sessions. The widely watched index is up more than 21% this year, versus the Nasdaq’s gains of 15.5% propelled by surging demand for generative AI, data centre buildouts and next-gen chips.

Asian stocks: Futures are mixed. Stocks traded mixed too with caution elevated ahead of the upcoming risk events, in spite of more record highs on Wall Street. The ASX 200 edged higher with mining and resources strength offset by defensive weakness. The Nikkei 225 made another new peak as it tried and just failed to close above 45,000 for the first time. The Hang Seng and Shanghai Comp were muted even after positive US-China talks around a framework agreement on TikTok. Presidents Xi and Trump are scheduled to speak on Friday.

Gold popped up to a new all-time top at $3,703 on the weaker dollar. Fed rate cuts are obviously eyed with any wavering from the near three 25bps cuts seen by markets over the next three FOMC meetings likely meaning a correction for bullion. But an underpinning of support has been provided by broad central bank buying this year, with gold now representing a bigger share of their reserves than Treasuries for the first time since 1996.

Day Ahead – Fed and Bank of Canada meetings

The Fed is fully expected to cut rates by 25bps, its first one this year. The FOMC appears to be more worried about the labour market cooling than elevated inflation and tariff effects yet to feed through. Updated economic projections are likely to see trimmed forecasts for growth and PCE, while the jobless rate rises. New dot plots will be published, with both the 2025 and 2026 median set to fall. The latter will be crucial in guiding markets, with currently around 68bps priced in total for 2025 – that means two 25bps moves today and in October, and above a 70% chance of another one in December.

Markets price in 23bps of easing at today’s Bank of Canada meeting, with a quarter point rate cut taking the overnight rate to 2.50%. That would be below the current midpoint of the BoC’s neutral estimate of 2.25-3.25%. Inflation remains broadly in line with the target, but unemployment ticked up above 7% and output contracted sharply in Q2. There’s around 45bps of easing priced in by year-end, which fully prices one rate cut, and around an 80% probability of another by the end of this year.

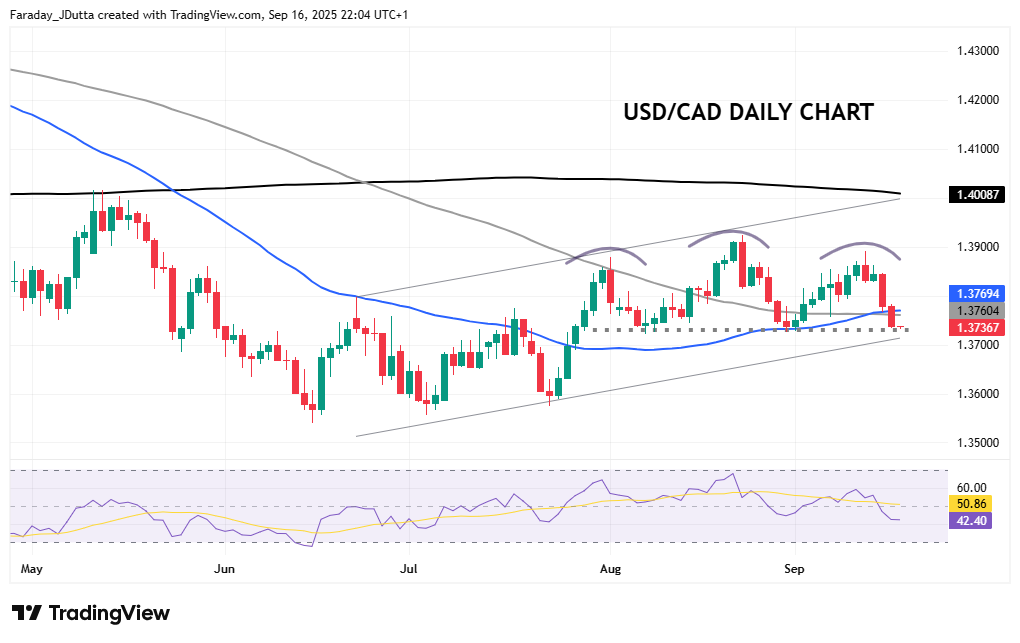

Chart of the Day – USD/CAD bearish pattern playing out?

Prices are currently trading around the 50-day and 100-day SMAs at 1.3761/68 though downward momentum has picked up this week after the bearish reversal candlestick last Thursday . Risks are potentially more tilted to a hold by the BoC and more aggressive easing by the FOMC. That would likely cause a sell-off in the major. There’s a potential bearish head and shoulders pattern nearly complete, with the trigger around 1.3730. That connects the early and late August lows in USDCAD. A measured move could mean a downside break towards the low 1.35s. A flipside surprise and a mildly more hawkish Fed which sees quarterly cuts over back-to-back-to-back would push the major higher.