Equities resume bid as focus turns to NFP

Headlines

* Hamas says ceasefire deal being studied in “positive spirit”

* USD/JPY falls again, though can’t break through 153 ahead of NFP

* Apple announces largest-ever $110bn share buyback but gives slow forecasts

* Dollar dips, stocks gain led by tech with sold gains expected in NFP

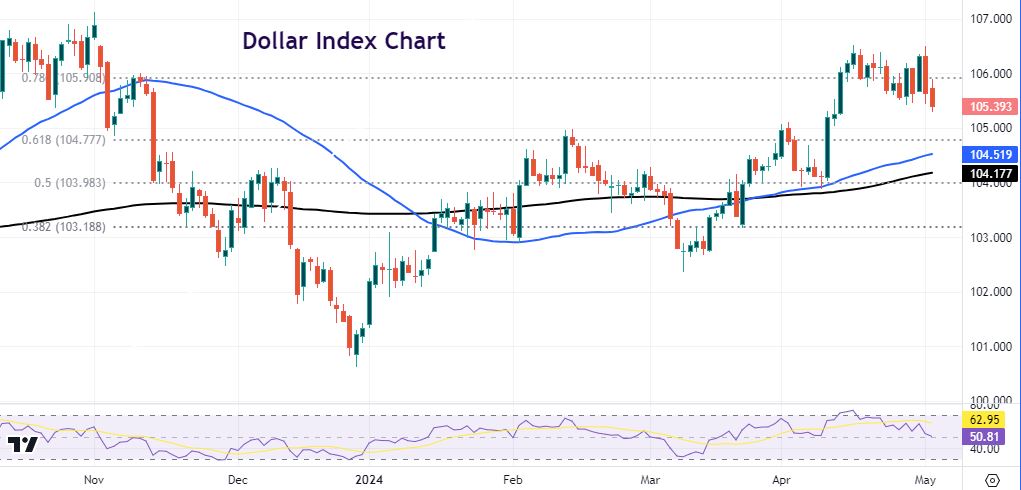

FX: USD sold-off again and printed three-week lows. Near-term resistance/support sits around 105.41/43. The Fed disappointed those looking for a more hawkish stance. But it needs more time for its tighter policy to do its work and that means it is heavily data dependent. Roll on today’s NFP…

EUR also printed an “inside day” with prices getting above 1.07. There seems scope for the single currency to improve after the mildly more dovish FOMC. Fears of a drop to 1.05 and parity have eased for now.

GBP underperformed though traded in a relatively narrow range. The OECD warned that the UK economy would be the weakest in the G7 next year due to interest rates and the fiscal environment. The upside is currently capped by the 200-day SMA at 1.2552.

USD/JPY dropped sharply again. Softer USD plus it seems like an aggressive MoF squeezing JPY shorts is in play. Wednesday’s late session low at 152.99 is an obvious downside target. Then the October 2023 and 2022 highs just below 153. Reuters reported that authorities did intervene immediately after the Fed. Two days has seen a roughly 500 pip move, from 158 to 153.

AUD moved above the 50-day and 200-day SMAs. Higher iron ore prices helped, but trade data disappointed. USD/CAD fell below 1.37. Better stocks are helping. Governor Macklem said the BoC were getting closer to cutting rates. He also added that there is a limit to how far the US and Canada can diverge, but they are certainly not close to that limit.

Stocks: US equities settled higher after a brief dip on hotter-than-expected unit labour costs. The broad-based benchmark S&P 500 finished 0.91% higher at 5064. The tech-dominated Nasdaq 100 added 1.29% to close at 17,541. The Dow Jones underperformed, up 0.85% to settle at 38,225. Tech led the way as a sector with health and materials the only ones in the red. Apple is up over 6% after hours. The tech giant announced that revenues fell 4%, weighed down by falling China sales, but narrowly beating analyst estimates. However, share buybacks totalling $110bn and an increase in the quarterly dividend by 4% soothed investors. The titan remains “very bullish about our opportunity in generative AI”. The stock price has fallen around 7% this year and lost its position as the world’s most valuable listed company to Microsoft.

Asian Stocks: APAC futures are mixed. Asian stocks traded mostly positive, but the upside was capped as investors mulled the FOMC meeting. The ASX 200 was higher on gold miners, financials and tech. The Nikkei 225 was relatively unchanged with currency moves in focus.

Gold fell but rebounded off support at this week’s lows around $2281/85. The next level below is $2260, with the 50-day SMA at $2229. All eyes are on today’s Us employment report.

Day Ahead – NFP Day

The US is expected to have added 250k jobs in April. This is slowdown from the prior 303k; with the 3-month average now at 276k. The unemployment rate is seen unchanged at 3.8%. Average hourly earnings are expected to rise +0.3% m/m, matching the pace seen in March. Fading weather-related support and broader evidence of easing labour demand is driving expectations of the slowdown in headline payrolls growth.

The employment indices of both April PMIs weakened, with the latter in contractionary territory for the first time since 2020. The small business survey fell to its lowest since the pandemic. But weather-related strength in payrolls has not been accompanied by softer gains in wages. An annual figure of 4% would be consistent with the Fed’s 2% price inflation target. Note that the private job quits rate continues to suggest that wage growth will ease to nearer 3.5% soon.

Chart of the Day – Can the dollar bounce back to recent highs?

Some weakness in the headline NFP print and especially a higher jobless rate could spark volatility with markets generally still positioned for enduring solid data. Money markets currently see around 35bps of rate cuts in 2024 with roughly a 60% chance of a 25bp rate cut in September. We note that Fed Chair Powell outlined a scenario on Wednesday where the Fed could cut rates if the labour market weakened enough, even when inflation remained moderately sticky.

Yesterday, the DXY broke down from its recent range trading between 105.50 and 106.50. But another blockbuster report would mean markets start pricing out any policy easing this year. All things equal, that could push yields and the USD higher towards the recent highs at 106.50. Stocks and gold could sell-off some more with near-term support in both assets not far away.