Nasdaq and Tech underperform in quiet trade

* Dollar was little changed as traders wait on Jackson Hole

* Dow posts fresh intraday record high but Nasdaq falls led by Nvidia

* President Trump is open to providing military air support for Ukraine

* UK inflation seen picking up in July, driven by services costs

FX: USD enjoyed very mild gains in a relatively narrow range day. There was mixed housing data but very little else to excite price action. We move into the second half of the week with Fedspeak at Jackson Hole front and centre. But there is little sign that markets are preparing or positioned for significant news. Market participation appears light and short-term FX volatility is weakening, with broader gauges of short-term USD volatility currently the lowest in a year.

EUR touched its 50-day SMA, now at 1.1642. There’s been little domestic news flow, but ECB President Lagarde speaks tomorrow, and also on Friday at Jackson Hole. PMIs will be important as a guide for how the zone is performing.

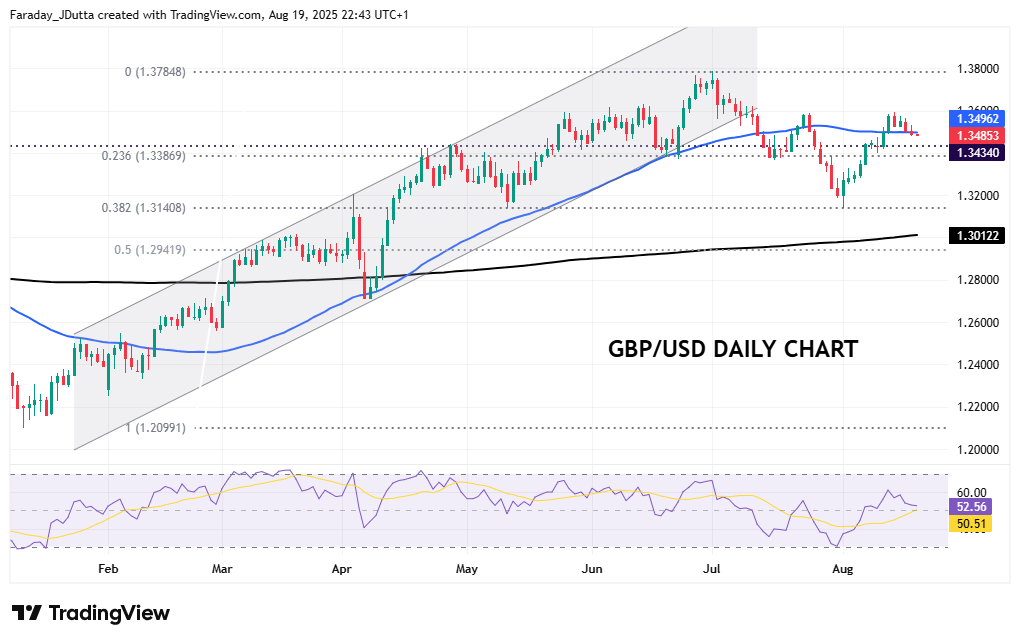

GBP dipped below the 50-day SMA though sterling outperformed most of its peers. Focus is on CPI data released tomorrow. See below for more details on that and the cable chart.

JPY traded relatively quietly with mild strength versus the dollar. The daily RSI is neutral hanging around 50. Japanese government bond yields are on the move, with the short end threatening fresh highs while the 10-year yield is near to fresh multi-decade highs. Domestic rate expectations are firming with eyes on PMIs and CPI figures on Thursday and Friday.

AUD got hit hard as the commodity dollar currencies all underperformed. The RBNZ meeting is coming up in a few hours. CAD was hit by cooler than forecast CPI data which pushed money market pricing of more BoC rate cuts more dovish. USD/CAD jumped up near to the August top at 1.3879.

US stocks: The S&P 500 printed down 0.57% at 6,412. The Nasdaq settled off, by 1.39% at 23,385. The Dow Jones finished up at 44,922 adding 0.02%. Breadth in the broader market was actually positive with the equal weight S&P seeing gains. Upside was led by Real Estate, helped by better-than-expected housing data, Consumer Staples and Utilities – all defensive sectors. Tech and Communication were the clear laggards weighing on the market. Nvidia fell 3.5%, its biggest drop in nearly four monthswith likely profit taking and rotation in tech ahead of Fed Chair Powell’s Jackson Hole speech on Friday. Home Depot gained over 3% after affirming guidance even though revenue was light. Earnings from Walmart and Target later this week will give further colour on the health of the US consumer.

Asian stocks: Futures are mixed. Regional markets were split. The ASX 200 came off all-time highs with losses in healthcare offset by some mild strength in tech and miners. The Nikkei 225 dipped as overbought conditions saw some selling after fresh record highs. The Hang Seng were kept afloat by central bank liquidity operations.

Gold broke down as bugs look to support just below $3,300. The market has been rangebound for the last three months underpinned by steady investment demand. Fading dollar strength and higher rate cut expectations have also favoured buyers.

Day Ahead – RBNZ, UK CPI

The RBNZ is expected to cut the OCR by 25bps to 3.0%. After a pause in July which halted their streak of six straight rate moves, data has not overly surprised with inflation contained, even if the near-term outlook has firmed due to higher food prices. The minutes from the most recent meeting highlighted the elevated level of uncertainty and the benefits of waiting until August considering near-term inflation risks. A data dependent and cautious stance is likely to be maintained. Initial resistance in NZD/USD is the 50-day SMA at 0.5985 with strong support around 0.5825/34.

July UK headline inflation is expected to tick up modestly to 3.7% in July, as food and fuel prices have risen. Core is forecast to remain unchanged at 3.7% and the all-important services metric is likely to increase to 4.8% and exceed the May MPC projection. A 4% peak is seen in September in the headline reading by many economists. That will likely prove a headache to the BoE given the hawkish dissent already on the MPC and that those price pressures will come ahead of the November meeting with an MPR. It could also upset their current quarterly pace of rate cuts which we have seen.

Chart of the Day – GBP/USD consolidating

Data picks up in the UK with inflation, then public finance figures and PMI numbers on Thursday. Domestic rate expectations are offering the pound good support as markets fade the pricing of cuts. Notably, the UK-US two-year spread is extending its push higher and recovering to levels last seen in early April. Of course, cable will also contend with the FOMC minutes and Fed Chair Powell’s speech at Jackson Hole on Friday. He is expected to push back versus Fed September 25bps rate cut expectations. Markets currently give that an 85% chance of happening. Bullish momentum in the major has slowed with prices just about holding the 50-day SMA at 1.3496 as support. Initial resistance is 1.3588/94 with support below at 1.3434, the swing high from September.