Stocks mixed as Dow hits another record high, NDQ lags

* Wall Street divided as defensives again outperform Tech

* Dollar quiet eyeing up possible employment data releases next week

* US October jobs and inflation data may never be released, says White House

* Nvidia supplier Foxconn signals sustained data centre boom

* US House returns to Washington for vote to end government shutdown

FX: USD was virtually flat on the day as the Dollar Index continued to consolidate around a long-term low from 2023 and a minor Fib level of this year’s decline around 99.57/51. The 200-day SMA sits above at 100.16. The FOMC are said to be ‘fracturing’ over a December rate cut after hawks touted a pause post-November’s decision. Government shutdown developments remain in the spotlight with hopes of a potential reopening on Friday and possibly September NFP data published the middle of next week. But this is still highly uncertain.

EUR found a small bid with prices still stuck below 1.16 in relatively quiet trade. Comments from the ECB’s Schnabel reaffirmed the bank’s neutral bias while signalling concerns about upside risks to inflation. News flow was very light while interest rate differentials widened, giving some support to the single currency over the dollar.

GBP lagged its peers again as it kicked off Wednesday falling to a low at 1.3084. The jobs data was dovish with the u/e rate pushing up to a fresh post-covid high at 5%. Also adding to sterling pressures are the domestic political tensions that are inevitably picking up ahead of the tax rising Budget. PM Starmer is ‘vulnerable’ to a leadership change, with a cabinet minister said to waiting in the wings. Markets will eye a new Finance Minister very warily if it plays out.

JPY was the major underperformer, as itinitially weakened with the majorposted a new cycle high at 155.04, a level last seen in early February. But sellers emerged in the US session and prices closed below the round number. We’ve had inevitable verbal intervention from Finance Minister Katayama who said she has seen “one-sided and sharp foreign exchange moves” recently, adding that it is being watched with a “high sense of urgency”.

US stocks: The S&P 500 gained 0.08%, closing at 6,852. The Nasdaq moved lower by 0.06% to settle at 25,517. The Dow Jones finished at 48,255, up 0.68% on the day and a new record high. Heavyweights in the index, UnitedHealth, Goldman Sachs outperformed. Sectors were split into red and green with Healthcare, Financials and Materials outperforming while Energy, Communication Services and Consumer Discretionary sold off the most. Coreweave shares had no respite after the prior day’s 16% plunge, falling another 3.4%. Paramount Skydance gave back 7% of its 9.7% gain after its results and strategy for further cost cuts and plans to invest $1.5bn next year. AMD jumped 9% as it expects annual data centre chip revenues to reach $100bn within five years and earnings to more than triple by 2030. Waymo, part of GOOGL, is set to roll out driverless taxis on highways in three US cities according to media reports. Cisco beat on earnings and guidance after hours, with the stock rising 5% in extended trading.

Asian stocks: Futures are mixed. Stocks were mixed too with markets digesting earnings. The ASX 200 was rangebound with upside seen in commodity sectors offset by tech and financials weakness. The Nikkei 225 closed marginally higher after trading between losses and gains around 51,000. Softbank was pressured despite reporting a 191% rise in revenues. The Hang Seng and Shanghai Composite were mixed with eyes on the PBoC’s monetary policy report which reiterated appropriately loose policy.

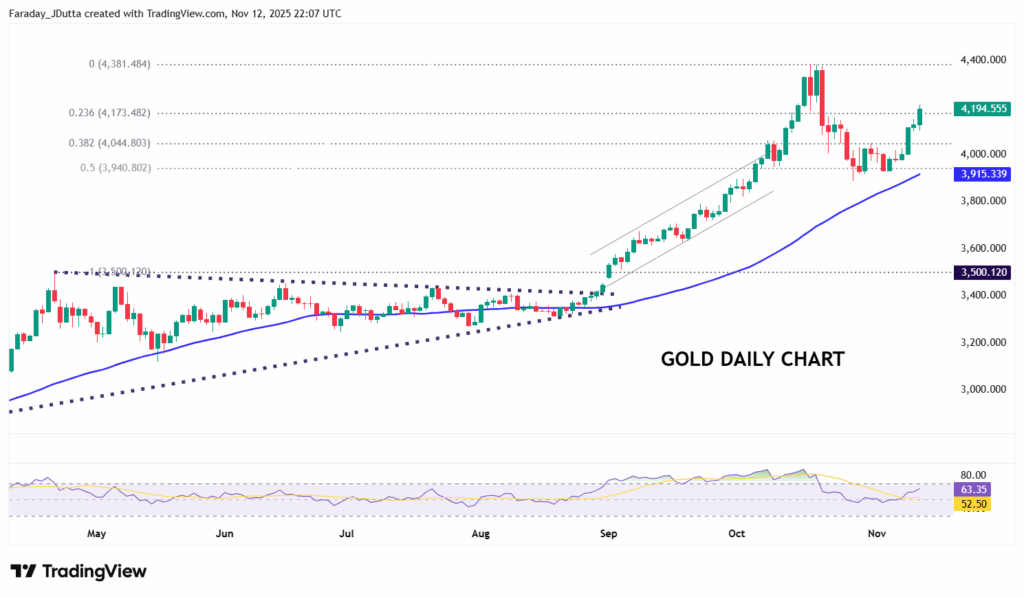

Gold enjoyed a fourth straight day of gains as bugs eye up the record top at $4,381. US Treasury yields dipped with the 10-year potentially heading back to the key psychological 4% mark.

Day Ahead – Australia Jobs, UK GDP

Expectations are for the Australia headline jobs to print at 20k, stronger than the prior 14.9k. Unemployment is forecast to move one-tenth lower to 4.4% in October. Employment growth has been easing as economists cite a rebalancing across industries. The labour market could remain relatively resilient next year if recent house price gains boost spending and investment. That then means the RBA could be on hold for a period of time, with the next cut not priced in fully until at least February 2026.

Consensus expects a reading of 0.1% for UK growth in the third quarter. This has moderated from the stronger first half of 2025, which was boosted by tariff frontloading. Weak PMIs and budget uncertainty will likely have hampered activity in the period from June to September. Growth in the new year is also predicted to slow as government spending pulls back, though much will be dependent on the November 26 Budget. The BoE is currently focused on inflation, which is expected to ease in the months ahead and result in a December 25bps MPC rate cut. We have two more CPI reports before that meeting next month.

Chart of the Day – Gold powers north

Bullion has responded fairly impressively to its biggest single day sell-off in years on October 21. Prices managed to consolidate around the 50% retrace level at $3925/40 of the September break to the upside of the previous record high at $3,500. Monday’s strong bullish momentum also pushed it above the 38.2% Fib at $4,044. US fiscal concerns remain a key and persistent source of support for investors seeking protection, while imminent Fed rate cuts remain on the table with central bank buying underpinning support for the precious metal. The record high is not that far away again, at $4,381.